Authored by Zoltan Vardai via CoinTelegraph.com,

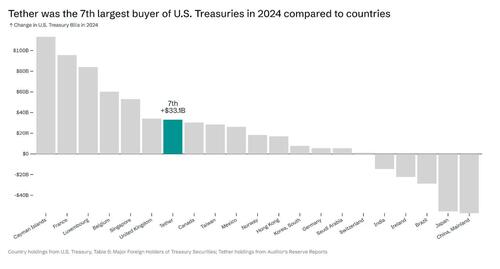

Tether, the $143 billion stablecoin giant, was the world’s seventh-largest buyer of United States Treasuries, surpassing some of the world’s largest countries.

Tether, the issuer of USDt, the world’s largest stablecoin, was the world’s seventh-largest US Treasury buyer, surpassing Canada, Taiwan, Mexico, Norway, Hong Kong, and numerous other countries.

The stablecoin issuer acquired over $33.1 billion worth of Treasurys, compared to over $100 billion purchased by the Cayman Island in the first place in global rankings, according to Paolo Ardoino, the CEO of Tether.

“Tether was the 7th largest buyer of US Treasurys in 2024, compared to Countries,” wrote Ardoino in a March 20 X post.

Source: Paolo Ardoino

However, Luxembourg and the Cayman Islands figures include “all the hedge funds buying into t-bills,” noted Ardoino in the replies, whereas Tether’s figures represent the investments of a single entity.

Tether is investing in US Treasurys as additional backing assets for its US dollar-pegged stablecoin since treasuries are short-term debt securities issued by the US government and are considered some of the safest and most liquid investments available.

Tether’s significant growth comes during a period of growing stablecoin adoption among both investors and US lawmakers.

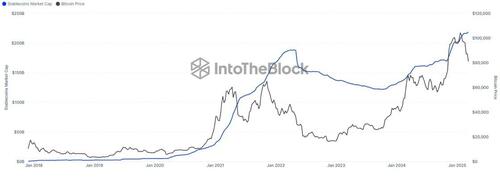

Source: IntoTheBlock

The growing stablecoin supply recently surpassed $219 billion and continues to rise, suggesting that the market is “likely still mid-cycle” as opposed to the top of the bull run, according to IntoTheBlock analysts.

US lawmakers are on track to pass legislation setting rules for stablecoins and cryptocurrency market structure by August, Kristin Smith, CEO of industry advocacy group the Blockchain Association, said during Blockworks’ 2025 Digital Asset Summit in New York.

Smith’s timeline echoes a similar forecast by Bo Hines, the executive director of the President’s Council of Advisers on Digital Assets, who said on March 18 that he expects to see comprehensive stablecoin legislation in the coming months.

“I think we’re close to being able to get those done for August […] they’re doing a lot of work on that behind the scenes right now,” Smith said on March 19 at the Summit, which Cointelegraph attended.

US President Donald Trump sits beside Treasury Secretary Scott Bessent at the March 7 White House Crypto Summit. Source: The Associated Press

“I’m optimistic when you have the chairs of the relevant committees in the House and the Senate and the White House that want to do something, and you’ve got bipartisan votes in Congress to get it there,” she added.

Loading...