By Heather Burke, Bloomberg Markets Live editor

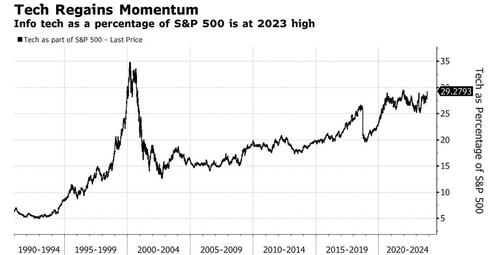

Tech has driven the bulk of the S&P 500’s gains over the past week -- and year. The sector is on track to increase its dominance, passing post-pandemic highs as markets adopt a more dovish tone on central banks.

Info tech was by the far the best performer of the 11 S&P 500 sectors in the past week -- and one of the few that actually gained, increasing its composition in the S&P 500. At over 29%, it’s the highest weighting since the end of 2021.

Tech has steadily become a bigger driver of S&P 500 returns. Last year’s drubbing amid higher interest rates led the sector to lose some relative momentum, but that’s returned this year. The search for safe havens, enthusiasm around AI and now optimism that rates have peaked have propelled tech and related companies higher.

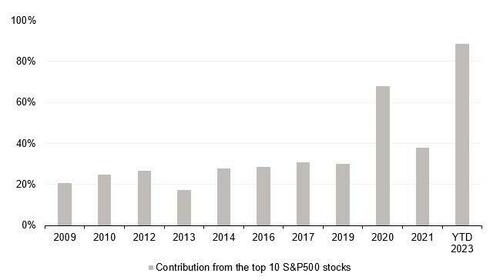

If it weren’t for the so-called Magnificent 7 stocks, which include Apple and Microsoft as well as consumer discretionary companies like Amazon.com, the S&P 500 would be down year-to-date.

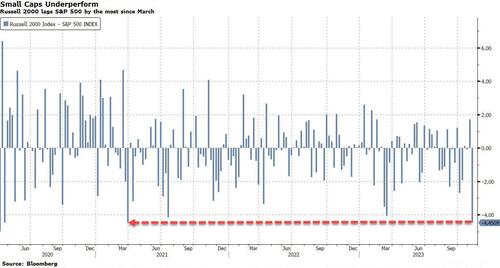

Tech also continues to thump small caps amid soft earnings, a tighter credit backdrop and lingering fears of an economic downturn. The Russell 2000 just posted its worst week versus the S&P 500 since March 2021.