The obesity drug price war has just begun following the Food and Drug Administration's Wednesday approval of Zepbound, a weight-loss drug from Eli Lilly and Company. Zepbound is anticipated to be more affordable than Novo Nordisk's Wegovy and will be stocked at US pharmacies after Thanksgiving.

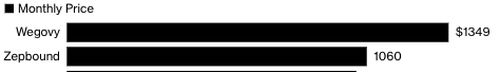

Zepbound is the latest entrant into the GLP-1 craze this year as obese Americans give up Pelotons for 'miracle' weight loss drugs that can help people lose up to 5% of body weight in a month. The new drug costs 21% less per month - or about $1,060 for a shot, compared with the premium price of $1,349 a month for Wegovy, according to Bloomberg.

Despite the high monthly cost of Wegovy, which can be comparable to expenses like car payments, rent, or mortgage payments and thus unaffordable for many folks, along with some insurance companies unwilling to pick up the bill, the introduction of Zepbound offers hope for more affordable options in the GLP-1 space.

Bloomberg noted Lilly's discount has likely instigated the opening move of a "war between the two drugmakers to win over insurers' dollars."

There could be a divide-and-conquer strategy between the two drugmakers with insures:

Even as list prices remain high, drugmakers often offer insurance companies steep behind-the-scenes discounts in exchange for favorable coverage, especially when there's competition from a very similar drug. What drugmakers lose in rebates — as these deals are often called — they gain in potential market share. Winning over the fragmented, complex and lucrative US health-care system is imperative for Lilly and Novo in maximizing long-term profits.

The two drugmakers are experts at navigating the behind-the-scenes fights with insurers for access to their patients. For years, the two competed to get coverage for injectable diabetes drugs, including more recently Mounjaro and Ozempic. They have historically split market-share for diabetes treatments, but the stakes are higher for weight-loss medicines. -Bloomberg

Bloomberg Intelligence's Michael Shah said Lilly and Novo "want to get broad access, so insurers will likely pit one against the other to secure the biggest discount."

Shah estimates that Novo has discounted Wegovy by at least 55% to secure access with insurers. He said the obesity drug war will likely mean rebates will move higher. This is a good sign for obese folks that more affordable pricing is ahead.

On Wednesday, after Zepbound's approval, Lilly wrote in a press release that its new drug is a "powerful new option for the treatment of obesity." Clinicals have shown it can help people lose up to 52 pounds in 16 months.

Patrik Jonsson, a Lilly executive vice president, recently said the more affordable Zepbound is a "signal from our side" that Lilly is taking drug costs seriously.

Bloomberg noted the obesity drug wars will accelerate this weekend:

Novo is expected to present data at the American Heart Association meeting from a big trial showing that Wegovy can prevent heart attacks and strokes in cardiovascular patients without diabetes. Those findings could also pressure insurers to cover the drug if it has more perceived health benefits.

The beginning innings of the obesity drug price war appear to have started this week to 'make America slim again' (also make billions of dollars along the way).