In its outlook for digital assets and Bitcoin, Fidelity Digital Assets called 2025 a “pivotal” year, when they should begin to have a broader impact across industries and economies.

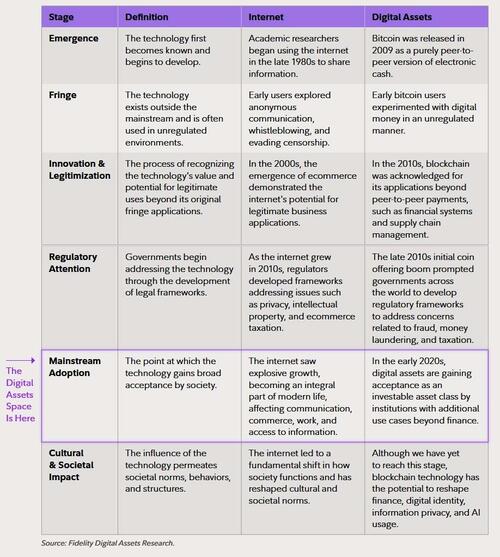

Citing research by economist Carlota Perez, Fidelity researchers said technological revolutions – like railroads or the internet, for example — typically disrupt multiple industries and fields and overhaul entire economies.

“Bitcoin and digital assets could fit this theory,” Fidelity Digital Assets researcher and report author Chris Kuiper wrote.

“We are potentially past what Perez describes as an early speculative period accompanied by financial boom and busts and are now possibly entering the phase of further adoption.”

The Fidelity paper said we are at the early stages of mass diffusion and adoption with digital assets in a process that will evolve over decades.

“2025 has the potential to be the year that is looked back on as the pivotal time where the “chasm was crossed” as digital assets begin to take root and embed themselves into multiple fields and industries,” Kuiper wrote.

“For example, in the past year, we have already seen discussions around nation-state adoption and increased corporate balance sheet adoption.”

So, while Bitcoin boomed in 2024, it is still in the early days of this new era of sustainable adoption, diffusion, and integration, Kuiper said.

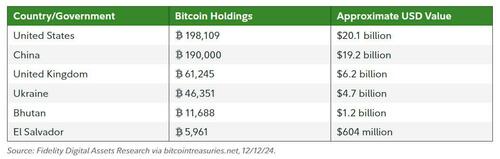

“We anticipate more nation-states, central banks, sovereign wealth funds, and government treasuries will look to establish strategic positions in Bitcoin,” said Fidelity Digital Assets research analyst Matt Hogan in the firm’s Jan. 7 paper titled “2025 Look Ahead.”

CoinTelegraph's Martin Young reports that Hogan believes more entities may take notice of the playbook employed by Bhutan and El Salvador “and the substantial returns they have been able to glean from such positions in a relatively short amount of time.”

He said that not making any Bitcoin allocation could become more of a risk to nations than making one due to challenges such as debilitating inflation, currency debasement and increasingly crushing fiscal deficits.

If the US goes ahead with its Bitcoin strategic reserve plans, “it is likely that nation-states would begin accumulating in secret,” Hogan said. “No nation has an incentive to announce these plans, as doing so could influence more buyers and drive up the price.”

Top nation states holding Bitcoin. Source: FDA

Hogan also predicted that digital asset-structured and managed products would “go mainstream” in 2025, adding it was “difficult to overstate the success” of spot Bitcoin and Ether ETH$3,237.85 exchange-traded funds.

“With the initial success of these products, it would not be unreasonable to expect 2025 to bring about more structured passive and actively managed digital asset products to the world of TradFi.”

Hogan also predicted that tokenization will be the “killer app” of 2025, with onchain value doubling from $14 billion to $30 billion by the end of the year.

“Tokenization is often seen as a buzzword in the world of blockchain technology, but its potential in financial services and beyond is only beginning to be realized,” he said.

The Fidelity researchers said investors should “prepare for acceleration” with “increased adoption, development, interest in, and demand for digital assets.”

They added that “investors are not too late to join the digital asset movement” and believed “we may be entering the dawn of a new era for digital assets, one poised to span multiple years — if not decades.”