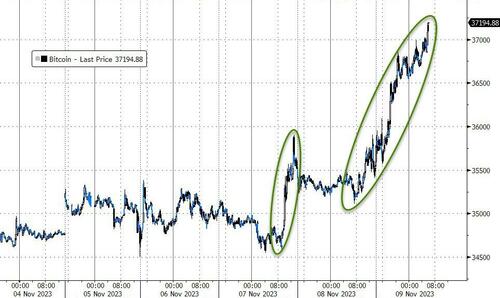

Bitcoin prices have exploded higher overnight, nearing $38,000, with the renewed bullish tone attributed to a combination of factors, including resurgent institutional interest, growing adoption, and a favorable macroeconomic climate.

Source: Bloomberg

For context, this price move has now erased the losses since the Terra stablecoin crisis 18 months ago...

Source: Bloomberg

As CoinTelegraph reports, while not expected until 2024, today, Nov. 9, marks the start of the period during which the long-awaited spot Bitcoin ETF approval announcement from regulators could theoretically come.

“We still believe 90% chance by Jan 10 for spot Bitcoin ETF approvals,” James Seyffart, research analyst at Bloomberg Intelligence, wrote on the topic.

“But if it comes earlier we are entering a window where a wave of approval orders for all the current applicants *COULD* occur.”

Reacting to Seyffart, financial commentator Tedtalksmacro agreed.

“BTC sure is trading like an ETF decision is due any moment,” part of his own commentary read.

However, Bloomberg's Seyffart noted that even if 19b-4 is approved, an S-1 approval could take weeks or months between approval and launch.

A total of 12 asset managers have filed for a spot Bitcoin ETF with the SEC.

Additionally, short-sellers might be exiting positions, fueling the move higher.

As CoinDesk reports, data shows just under $50 million in liquidations occurred in a four-hour period during early Asian trading hours, creating a "short squeeze"

Most notably, as Goldman Sachs' Crypto team points out, initial market data suggests that market activity was heavily institutional with four main indicators:

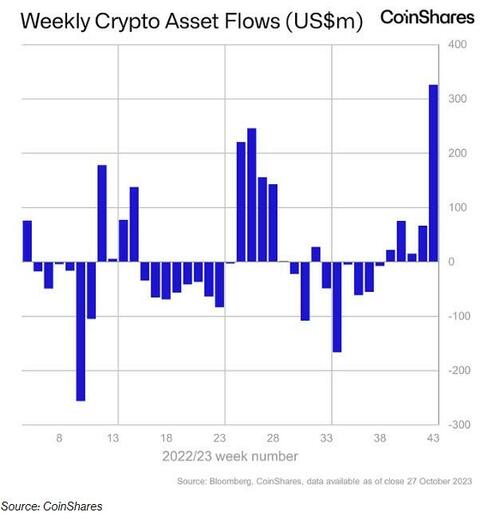

1. In October, we saw approximately $437m of inflows into BTC exchange - traded products (Bloomberg). On a weekly basis, BTC-based digital asset investment products led the largest single-week inflows into crypto funds since July 2022, for the week ending 27 Oct 2023. BTC-based funds accounted for 90% of the total crypto fund inflows, totaling $296m ( Bloomberg ).

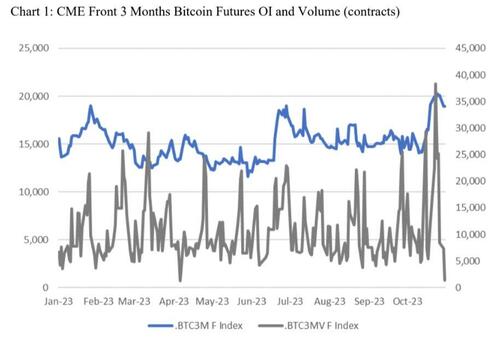

2. Most noticeable change was on CME, where Bitcoin futures open interest notched to an all-time high of 20,369 contracts on 25 Oct 2023 ( CME Group ), and 6 of the top 10 open interest days for bitcoin futures occurred between 20 and 27 Oct 2023. Total open interest on CME hit $3.58b on 30 Oct 2023. In October, CME surpassed the 100k BTC mark for the first time, overtaking Bybit and OKX to rank second behind only Binance ( CoinDesk ) among exchanges offering standard Bitcoin futures and perpetual futures. The daily traded volume for the front 3 - month expiries on CME also notched a YTD high of 25,185 contracts on 25 Oct 2023.

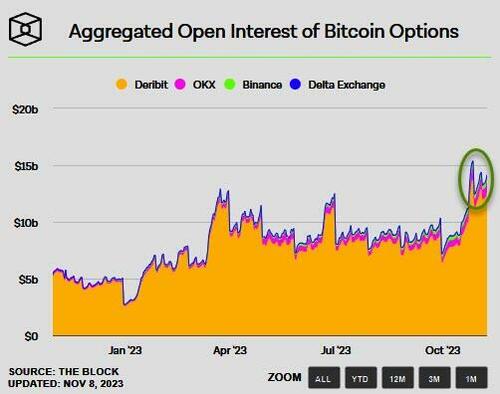

3. In addition, the open interest across BTC options also reached an all - time high of $15.4b on 27 Oct 2023 ( The Block Data )

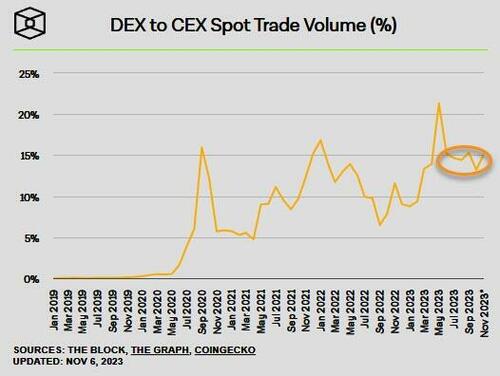

4. On - chain activity remains muted relative to rest of the year, with daily active address count of 1.1m (vs 950k addresses (annual average in 2023) ( Coinmetrics ) and DEX to CEX spot trade volume at 13% (vs May’23 21%) ( The Block Data ).

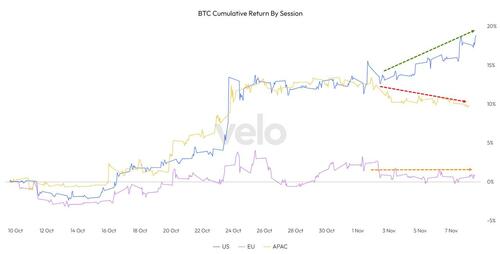

James Van Straten, research and data analyst at crypto insights firm CryptoSlate, wrote in part of his latest research, referencing data from on-chain analytics firm Glassnode, which showed U.S. buyers sustaining the rally.

“Americans carrying this thing,” William Clemente, co-founder of crypto research firm Reflexivity added.

The $37,000 milestone sets up the more significant $40,000 psychological barrier to be broken, instilling a renewed sense of optimism in the cryptocurrency community.

“It’s always gonna be this” way, said Zaheer Ebtikar, founder of crypto fund Split Capital.

“People can’t help it. [Crypto] is literally the most FOMO industry ever.”

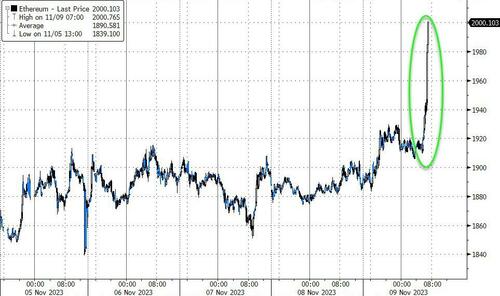

Meanwhile, Ethereum is also soaring higher, touching $2000 for the first time since July as interest in DeFi, and more specifically 'yield farming' begins to emerge once again...

As Bloomberg reports, yield farming was once a popular method for crypto projects to bootstrap new users in a short amount of time. It was especially popular in the ultra-low-interest-rate environment during the Covid-19 pandemic. That changed when crypto prices tumbled and traditional interest rates rose.

“It just took the industry a bit of time to adjust to a regime of high tradfi yields with low crypto volumes, and being able to create competitive product in that space,” said Leo Mizuhara, founder and CEO of DeFi institutional asset manager Hashnote. Tradfi is a popular term used to describe traditional finance.

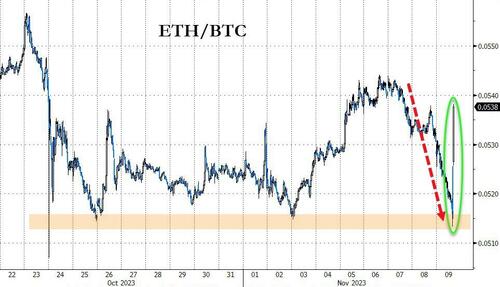

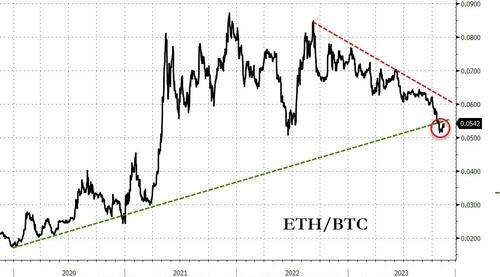

The surge in ETH has reverted its recent weakness against BTC...

As we tweeted on Oct 20th, the ETH/BTC cross was at a critical support level and today's price action suggests a push back above that...

The key question on investors’ minds now is whether the market has structurally changed?