Taiwan Semiconductor Manufacturing Company shares are on track to record their strongest annual performance since the Dot Com bubble, as the world's largest contract chipmaker ramped up production of artificial intelligence chips designed by Nvidia and Advanced Micro Devices, driven by surging data center demand.

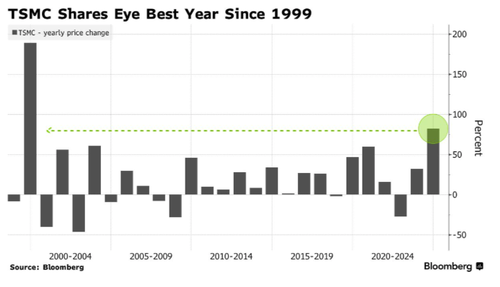

Investor enthusiasm for AI trades persists into the final trading days of the year. TSMC shares are up 82% this year, marking their best annual performance since 1999.

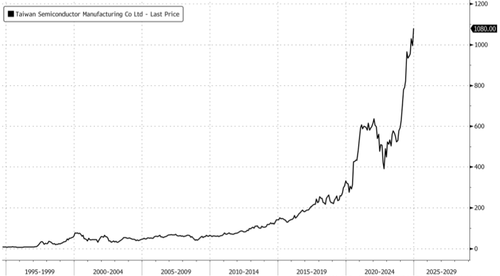

Shares have soared to record highs.

TSMC is one of three companies capable of manufacturing AI chips at scale to supply data centers following the launch of OpenAI's ChatGPT in 2022.

The Taiwan-headquartered chipmaker reported a 54% year-over-year jump in third-quarter net profits and lifted its full-year sales outlook on robust AI chip demand.

In October, CEO C.C. Wei told investors: "One of my key customers said the [AI] demand right now is insane," adding, "The demand is real. I believe it's just the beginning of this demand ... and it will continue for many years."

Kevin Net, head of Asian equities at Financiere de L Echiquier, told Bloomberg on Monday, "TSMC remains the best way to play the AI theme without having to pick a winner or a technology, at a reasonable valuation," adding that the next big market capitalization event for the company will be Nvidia's presentation at CES 2025 next month and TSMC's upcoming results and guidance.

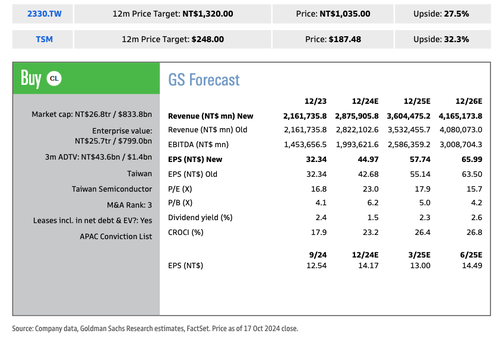

Earlier this month, Goldman's Bruce Lu and Evelyn Yu penned a note to clients about their meeting with dozens of investors across Europe and Singapore. They found that TSMC still showed high interest among investors.

"TSMC was the most frequent asked-about name during our marketing trip," they said, adding, "We believe TSMC will benefit from not only training AI demand but also on the Inference side as it moves into more edge AI demand given its leadership stance on advanced nodes and advanced packaging."

The analysts continued:

In terms of its next catalyst, we see high possibility of TSMC raising its profitability outlook and long term revenue CAGR in its incoming January analyst meeting: to note, in our September Conference in San Francisco (see note), TSMC CFO commented that the guidance of 15-20% of revenue CAGR during 2021-2026 would also potentially apply to the next 5 years (vs guided timeline of 2021-2026).

As for profitability, the company is now guiding its long term GM to be '53% and higher', with the new higher pricing for 3nm/5nm nodes starting 2025, we believe this would potentially be a key factor for TSMC to raise its long term profitability target.

They explained their 'Buy' rating on TSMC:

We have a 12m TP of NT$1,320, which is derived by applying a target P/E multiple of 20x to our 2026E EPS. Our 20x target P/E is benchmarked to its trading average during its last earnings upcycle where its 4-year earnings CAGR in 2018-2021 was 19.3% vs. our 3-year EPS CAGR at 21.1% during 2024-26E. For the ADR (TSM), we have a 12m TP of US$248, based on a USD/TWD rate of 32.0 and ADR premium of 20% to reflect the stronger performance of SOX over Taiex especially starting 2024.

Let's not forget that TSMC is the foundation of the expanding digital economy that powers AI data centers and enables chatbots to function. The question remains whether TSMC's AI demand outlook is accurate...

We cited a separate Goldman note Monday explaining that the "US Internet industry entering 2025 on a firm footing." However, the analysts pointed out that "platforms must prove the value of their AI investments as elevated investment spending enters the third year, with investors demanding returns."