Arabica futures in New York surged to 13-year highs amid concerns about inventory stockpiles this season in Brazil, the world's top producer. With next year's harvest still eight months away, supply fears are beginning to spook agricultural traders.

Carlos Santana Jr., a Brazil-based commercial director at trader Ecom Group, told Bloomberg, "There are about eight months before the start of the next season, and the percentage of coffee sold by Brazilian growers is very high."

"We might not have enough coffee to get to the next season," Santana warned.

Consultancy Safras e Mercado calculated that 70% of the current harvest has been sold, much of which pours into international markets. That compares with 64% in the previous season.

The strong stream of exports led the US Department of Agriculture's Foreign Agricultural Service to estimate a reduction in Brazil's coffee stockpiles. Inventories are expected to reach only 1.2 million bags when the current season ends in June. That is a 26% decrease compared to the previous year. The outlook for next year's harvest is also rather dire.

Skyrocketing prices have been fuelled by trees in Brazil that have an ultra-low number of cherries containing coffee beans, a byproduct of adverse weather conditions, such as drought, this year. Simultaneously, consumers have ramped demand for brews that require additional beans.

Arabica futures in New York have touched the highest levels since 2011.

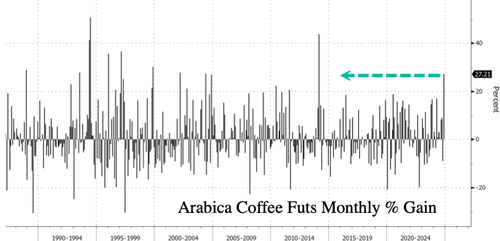

If monthly gains of +27% hold, Arabica futures will have sustained the biggest gains since February 2014.

Citi commodity strategist Arkady Gevorkyan told clients, "Coffee's bull run [is] likely to continue near term," adding, "We revise up our three-month target for Arabica coffee to $US3.10 a pound, and note a significant upside risk skew to this forecast as supply from Brazil and Vietnam could still underperform."

Soaring demand for ready-to-drink coffee, combined with a bleak supply outlook in Brazil, will likely continue driving prices higher through the end of the year. This is terrible news for consumers as food inflation remains sticky.