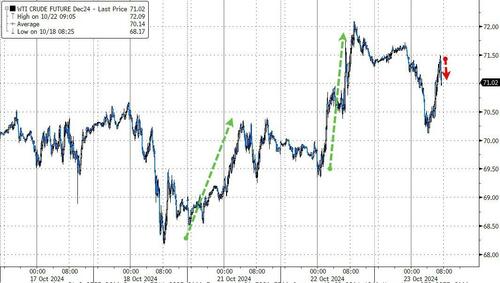

After two days of gains, oil prices roller coastered overnight with WTI testing down to $70 before bouncing back up to $71.50 ahead of this morning's official inventory and supply data. API reported a mixed bag last night as we are sure the impact of the Hurricanes is still rippling through this data.

API

-

Crude +1.64mm (+800k exp)

-

Cushing -216k

-

Gasoline -2.02mm (-1.3mm exp)

-

Distillates -1.48mm (-1.6mm exp)

DOE

-

Crude +5.47mm (+800k exp)

-

Cushing -346k

-

Gasoline +878k (-1.3mm exp)

-

Distillates -1.14mm (-1.6mm exp)

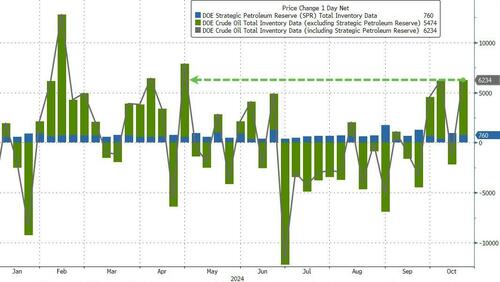

Crude stocks soared by 5.5mm barrels last week (well above expectations), Gasoline stocks unexpectedly built as gasoline inventories dropped for the 5th straight week...

Source: Bloomberg

Including the 760k barrels added to the SPR, this is the biggest weekly build since April...

Source: Bloomberg

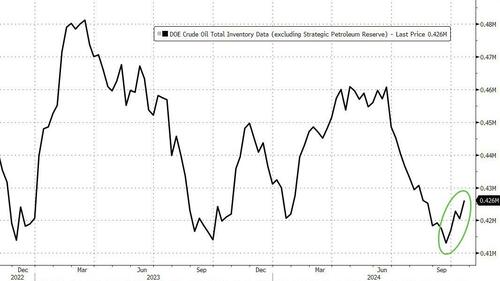

That pushed total crude stocks up to their highest since August...

Source: Bloomberg

US Crude production remains at record highs (13.5mm b/d)...

Source: Bloomberg

WTI dipped off rebound highs after the official data...

“As concerns about Iran oil supply have eased, market focus is shifting back to the risks of oversupply in 2025,” Goldman Sachs analysts including Yulia Zhestkova Grigsby said in a note.

“Downside price risks from high spare capacity and potentially broader trade tariffs outweigh upside price risk from geopolitical supply disruptions.”