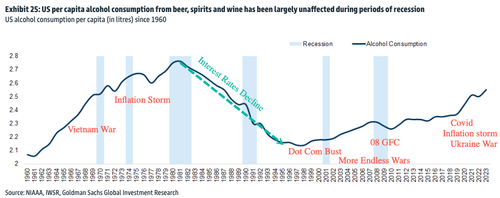

A broad overview of America's beer, spirits, and wine consumption reveals a steady increase since the Dot Com bust, with per capita levels approaching the highs last seen during the inflation-driven misery storm of the 1970s. Economic misery and rising alcohol consumption often go hand in hand.

"During periods of recession, US per capita alcohol consumption from beer, spirits and wine has been very resilient. Total beer volume declined in 2009 whilst spirits volume continued to grow," Goldman's Olivier Nicolaï told clients in a note on Tuesday.

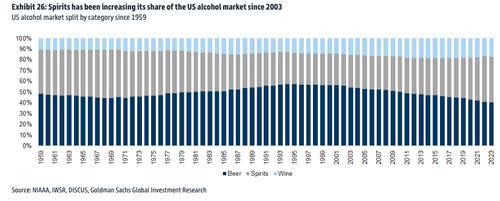

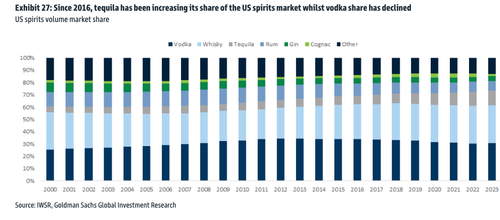

Nicolaï noted, "Within overall US alcohol consumption, beer has been steadily losing share to spirits over the last 20 years. Within the spirits category, tequila has been gaining market share at the expense of vodka over recent years."

Six decades of US per capita alcohol consumption data shows how war and economic misery can impact drinking rates among consumers. From the 1960s to the 1970s, the rate of alcohol consumption soared on a per capita basis, likely due to foreign wars and high inflation. Around the time the Fed regained control of inflation with interest rate hikes in the late 1970s and early 80s, consumption rates eventually topped and fell as easier economic conditions led to boom cycles. However, drinking rates bottomed at the end of the 90s, rising just after the Dot Com bust, rising higher with endless Middle East wars, dipped slightly but jumped following the 2008 GFC, and surged in recent years after government-enforced lockdowns during the pandemic, Ukraine War, and ongoing inflation storm.

One noticeable trend Nicolaï found in the latest surge in drinking trends is that spirits have become increasingly popular in the US market as beer demand slides.

He said tequila has become the top spirit of choice among US drinkers, a trend that became apparent in 2016.

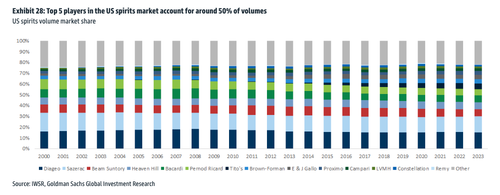

Only five players control about 50% of spirit volumes in the US.

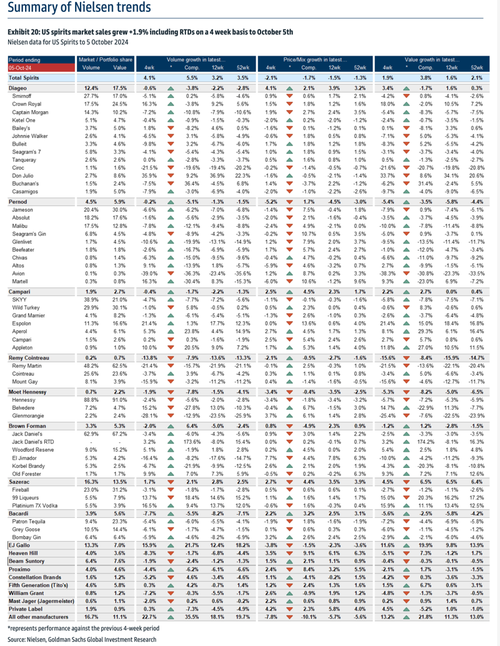

Here's the latest US spirits market data via Nielsen about drinking trends on a 4-week basis to October 5...

Given all of this, Nicolaï explained to clients his rating coverage on each of the top spirit producers:

- Diageo (Sell): USA accounted for 35% of Diageo FY23 sales and 45% of EBIT. Diageo's volumes including RTD declined -0.6% (-2.9% Aug/Sept). Sales were up +3.4%, ahead of the market at +1.9%. Performance continued to be driven by Don Julio, which grew volumes +35.9%, and Crown Royal, which accelerated to +16.3% thanks to Crown Royal Blackberry launched in February 2024. Casamigos volumes are weak down -7.9% (vs -8.5% in Aug/Sept). Captain Morgan underperformed the category, down -7.2% (vs -5.8% for the category). Cîroc (-21.7%) and Smirnoff (-5.1%) volumes both underperformed.

- Pernod (Buy): USA accounted for 19% of Pernod FY23 sales and 24% of EBIT. Pernod's volumes including RTD declined -0.2%, sequentially improving from -3.4% in July/August. Sales declined by -5.4% due to negative price/mix. Volumes excluding RTD declined -5.4%, underperforming the market. Jameson volume improved sequentially to -6.6%, from -8.3% in Aug/Sept. Absolut saw volumes sequentially improve to -1.6%. Martell saw strong volume growth, up +16.3%, against an easier comp. Glenlivet (-10.6%) and Malibu (-7.8%) volumes sequentially improved. In RTD, Absolut saw strong growth up +75.4%. Due to destocking, we expect -10% sales in the US for Pernod in Q1 on October 17 (here) and are below consensus for the group.

- Campari (Neutral): USA accounts for 28% of FY23 group sales. Campari volume declined -0.4%, with sales up +2.2% still above the market. The sequential volume improvement was driven by an acceleration in Aperol to +5.3% (+2.0% in Aug/Sept). Espolon Tequila performed strongly, accelerating volumes to +21.4%, whilst SKYY volumes also improved sequentially to -4.7% (-11.1% in Aug/Sept). Appleton (+10.0%) and Wray and Nephew (+5.7%) saw strong growth in rum. Courvoisier (acquired April 2024) volume are declining -9.4%, but improved sequentially (-14.8% in September/August).

- Remy (Buy): USA accounts for 35% of FY24 group sales. Remy saw volumes decline -13.8%, with sales down -15.6%, implying -2.1% negative price/mix. In Cognac, Remy Martin volumes declined -21.4%, remaining broadly unchanged sequentially against a more difficult comp. Hennessy volumes declined -2.4%, but saw -3.4% price/mix compared to -0.1% for Remy Martin. Cointreau volumes improved sequentially to -3.7%. (vs -6.8% Aug/Sept).

The big takeaway is that US consumers have been steadily increasing their alcohol intake in the last several years, some of which has been spirits, amid the blowback in failed Bidenomics igniting an inflation storm - unleashing economic misery - similar to what was seen in the 1970s. Plus, disastrous foreign policy, igniting some of the highest World War III threats in a generation, has also pushed more folks to the bottle.