Volkswagen AG lowered its profitability forecast for the second time this year due to sliding passenger vehicle demand, highlighting the bumpy transition to electric vehicles. Additionally, Germany's economy is faltering, if not already in recession, and the pain has been widespread across the automotive sector. The economic slowdown in China has further pressured vehicle sales for luxury German automakers.

The German car maker, known for producing Audi, Bentley, Cupra, Jetta, Lamborghini, Porsche, SEAT, Škoda, and Volkswagen brands, announced Friday that its forecast for operating return on sales - a closely watched measure of profitability - had been slashed to 5.6%, down from a forecast of 7% in July. VW lowered its expectations partly due to the expected closure costs of an Audi plant in Belgium.

Bloomberg provided a snapshot of VW's updated full-year guidance:

-

Sees operating return on sales 5.6%, saw 6.5% to 7%, estimate 6.51% (Bloomberg Consensus)

-

Sees vehicle deliveries 9 million units, estimate 8.1 million

-

Sees Automotive net cash flow EU2 billion, saw EU2.5 billion to EU4.5 billion, estimate EU3.27 billion

VW has been plagued by several issues, including slowing Chinese vehicle demand, rising competition in EVs, and a deteriorating macroeconomic environment.

Our latest reporting on VW paints an ominous future for the legacy automaker:

Then there's this...

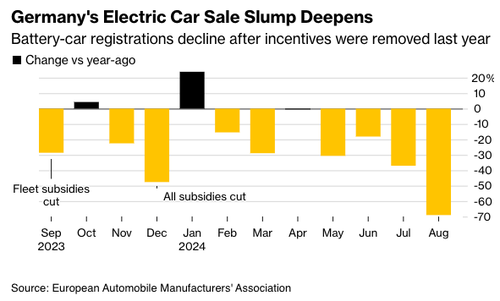

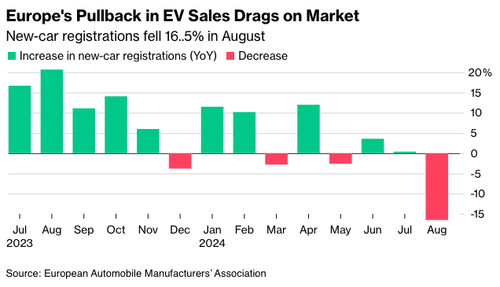

Across Europe, vehicle sales are dramatically slowing.

"The downturn in EVs is putting carmakers like VW and Renault SA at risk of hefty fines as tighter European Union fleet-emissions rules are set to kick in next year," Bloomberg recently noted.

Meanwhile, what is critical to understand are 'green' (de-growth) policies pushed by elected and unelected far-left progressive officials that undermine Western economies, essentially making companies unable to compete in Asia. In China, energy is abundant and cheap, unlike in Germany.

De-growth (climate) policies are strangling Western companies, while China constructs new coal plants at six times the rate of any other country, supplying its manufacturers with an abundance of cheap energy. How can the West possibly compete? The answer is... they can't.