Authored by Lance Roberts via RealInvestmentAdvice.com,

Since 2020, momentum investing has generated significantly better returns than other strategies. Such is not surprising, given the massive amounts of stimulus injected into the financial system. However, Brett Arends for Marketwatch noted in 2021 that momentum investing can give you an edge. To wit:

“Its success ‘is a well-established empirical fact,’ and can be demonstrated across multiple assets and over 212 years of stock market data, argues money manager Cliff Asness and his colleagues. It is ‘the premier market anomaly,’ writes analyst Gary Antonacci. It trounces a simple ‘buy and hold’ stock market strategy going back almost 100 hundred years, estimates money manager Meb Faber.”

While momentum investing is appealing in a liquidity-driven bull market, is it always the best strategy? As noted in the “Best Way To Invest:”

The last decade has been a boon for the index ETF industry, financial applications, and media websites promoting ‘buy and hold’ investing and diversification strategies. But is the ‘best way to invest’ during a bull market also the best way to invest during a bear market? Or, do different times call for different strategies?

That is the question we will explore further.

Momentum Investing Isn’t Passive

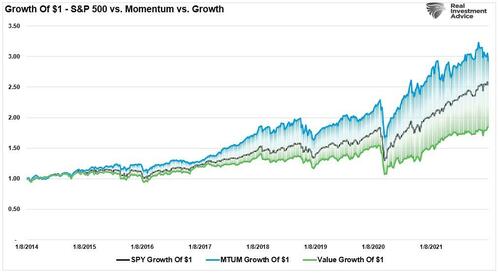

Brett compares several ETF funds over the past five years in his discussion. To simplify our analysis, we will use the following three ETFs from 2014 to the present. (2014 is the earliest date that all three ETFs have performance data.)

-

SPDR S&P 500 ETF (SPY) as the “buy and hold” proxy,

-

IShares Momentum ETF (MTUM) as the “momentum” proxy; and,

-

IShares Value ETF (IVE) as the “value” proxy.

For our analysis, we calculated the growth of $1 invested in each ETF from January 2014 on a nominal capital appreciation basis only.

At first blush, the obvious choice for investors was momentum when compared to the S&P 500 or value.

So, is that all there is to it?

Do you buy a “momentum” fund and forget about it?

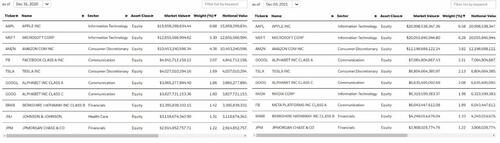

Well, not so fast, says Brett. However, while I agree with Brett, it is for a different reason. The issue with “Momentum investing” is that it is not a passive strategy. For example, if we look at the top 10 holdings of MTUM, we can see the changes being made to the ETF as momentum changes in the market.

At the end of 2020, Danaher Corp (DHR) and Thermo Fisher (TMO) were among the top 10 holdings as the market chased healthcare-related stocks due to the pandemic. By September 2021, with the steepening yield curve and developments related to vaccines and bitcoin, Paypal (PYPL), Moderna (MRNA), and major banks dominated the top 10. By the end of 2021, PayPal was replaced by Nvidia (NVDA), Costco (COST), and accounting stocks.

Looking at the present, following the 2022 correction and subsequent rebound, the holdings have once again shifted. After a strong run in 2024, Costco has returned to the top 10, replacing Netflix (NFLX) and Microsoft (MSFT).

The outperformance in Momentum is due to the changes in holdings to capture price trends. However, if you hold SPY, the only changes over the last few years are due to the weighting in the top-10 holdings.

Again, momentum seems to be the obvious choice.

But it isn’t.

Momentum Investing Doesn’t Always Win

Brett makes a very important point about momentum investing.

Researchers say investing in so-called “momentum” stocks, is the best documented and most durable “edge” in the market.

Critically, that applies to owning individual equities in a portfolio. Not passively holding an ETF.

There is a difference.

Yes, on a passive basis since 2014, momentum has outperformed the benchmark and value indices. However, passively holding an ETF negates the value of momentum investing.

“And there is an inbuilt cautious bias to this portfolio as well, because it only holds stocks that have positive trailing returns. In a bear market you may be invested in nothing whatsoever. As Meb Faber and others have pointed out, momentum strategies can help you avoid the worst market turmoil.” – Brett Arends

Read that again.

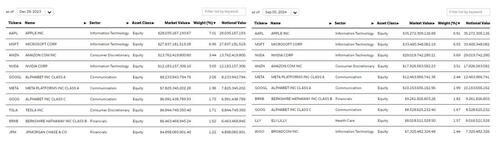

As a strategy, momentum investing raises cash when the momentum of holdings turns negative. Such is not the case for an ETF that must always remain invested. If we break the comparative performance down into specific periods, the value of the momentum strategy gets lost.

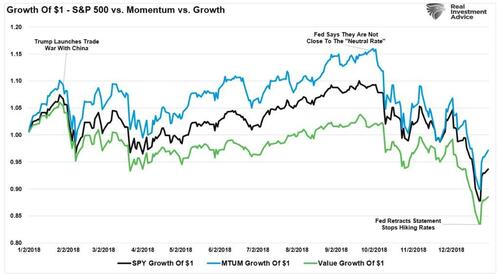

In 2105 and 2016, momentum provided no hedge against the Fed’s “taper” and Brexit.

Similarly, in 2018, relative performance was worse than the benchmark during the Fed’s “taper tantrum.”

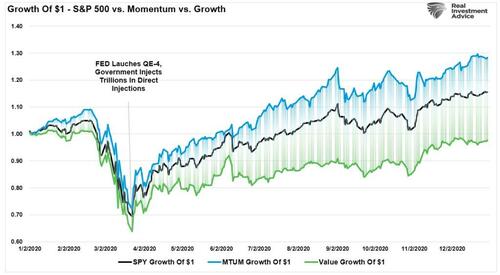

Holding a momentum ETF in early 2020 did little to shield you from the downturn. However, momentum benefited from the recovery fueled by trillions in monetary and fiscal policies.

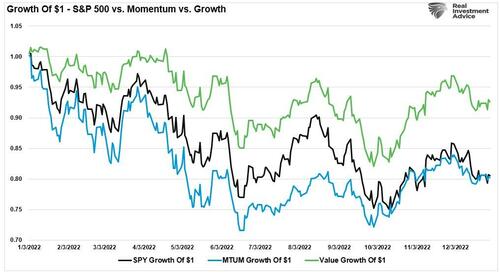

During 2022, holding a momentum ETF significantly underperformed the value index.

As Brett noted, momentum investing’s value, when applied to a portfolio of individual equities, is that it can help avoid significant capital destruction during market downturns.

However, the value of the momentum strategy gets lost when applying an active strategy to a passive holding.

Choosing The Right Strategy At The Right Time

As a strategy, momentum investing works well when properly applied to a portfolio of individual securities.

One of the most interesting aspects of this portfolio though is not only that it has a lot of hard numbers backing it up, but that it is in theory accessible to any ordinary investor who can screen stocks by monthly performance.

He is correct, and it is something that we provide at SimpleVisor daily, as shown:

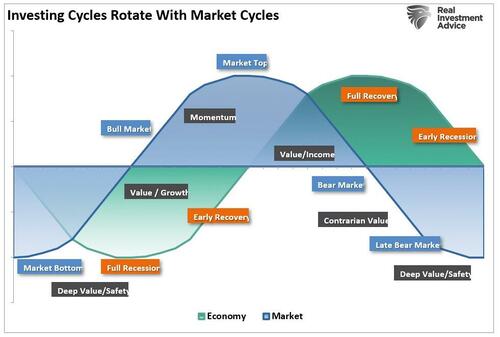

Momentum investing works exceptionally well during a strongly trending bull market. However, it is critical to remember that strategies change during a bear market. As shown below, market cycles tend to precede economic cycles, so investment strategies should change with both economic and market cycles.

Such will be critically important when the next bear market begins.

The Return Of Value

As Brett aptly concludes:

My biggest problem with “momentum” as an investment strategy is that you are basically abandoning any attempt to do your own fundamental analysis whatsoever. It feels to me like the stock market equivalent of “social” media, jumping on the latest crowd mania regardless of any merits.

But maybe that’s why I should do it. If Rome is falling, and the Dark Ages are coming, shouldn’t I just give up and bet on the Vandals?”

I wouldn’t give up just yet.

The chart shows the difference in the performance of the “value vs. growth” index. (Fidelity Value Fund vs S&P 500 Index)

Notable are the periods when “value investing” outperforms.

While it may seem like the current bull market will never end, abandoning decades of investment history would be unwise. As Howard Marks once stated:

“Rule No. 1: Most things will prove to be cyclical.

Rule No. 2: Some of the most exceptional opportunities for gain and loss come when other people forget Rule No. 1.”

The realization that nothing lasts forever is crucial to long-term investing. To “buy low,” one must first “sell high.” Understanding that all things are cyclical suggests that investment strategies must also change.

The rotation from “momentum” to “value” is inevitable. It will occur against a backdrop of economic weakness and price discovery for investors quietly lulled into complacency following years of monetary interventions.

“Relative valuations are in the far tail of the historical distribution. If, as history suggests, there is any tendency for mean reversion, the expected future returns for value are elevated by almost any definition.” – Research Affiliates

The only question is whether you will be the buyer of “value” when everyone else is selling “momentum?”