A week ago, Boeing executives thought they had secured a new labor contract for approximately 33,000 unionized workers in Washington state. However, on Thursday night, 94.6% of union members rejected Boeing's contract offer, while 96% voted for a strike. Boeing's last major labor action occurred in 2008 and persisted for eight weeks.

CNBC reported Monday that Boeing announced a hiring freeze on nonessential staff travel and reduced supplier spending to preserve cash piles. This could be a troubling sign that executives at the struggling planemaker forecast the strike might last weeks, if not longer.

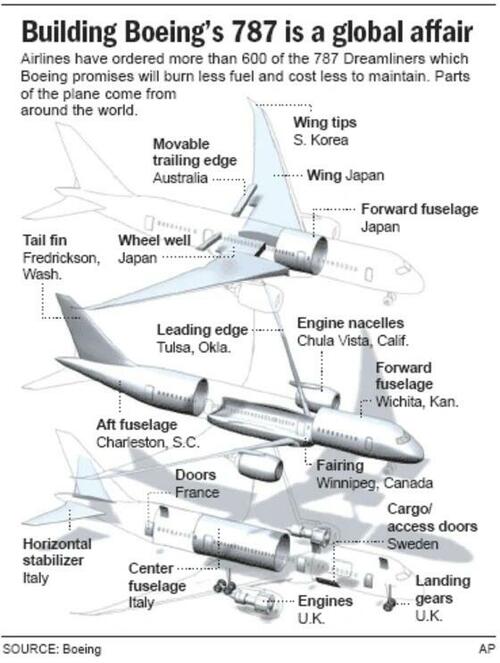

Boeing CFO Brian West told employees via an internal memo that "significant reductions" to supplier spending are imminent. He said purchase orders for 737 Max, 767, and 777 jetliners must be halted.

"We are working in good faith to reach a new contract agreement that reflects their feedback and enables operations to resume," West wrote in the note, adding, "However, our business is in a difficult period. This strike jeopardizes our recovery in a significant way and we must take necessary actions to preserve cash and safeguard our shared future."

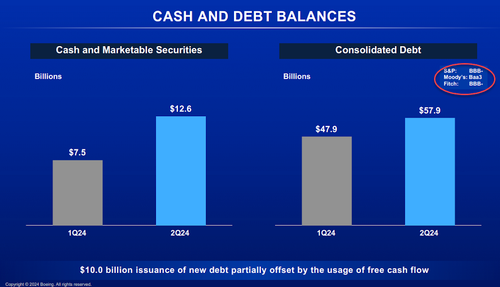

Credit rating agencies Fitch and Moody's warned Friday that a downgrade of Boeing's credit rating into junk bond status is just ahead. Standard & Poor's had already warned that a downgrade would likely occur after the strike materialized.

Moody's noted that prolonged labor disruptions could undermine Boeing's commercial airplanes recovery, complicating liquidity as $12 billion in debt matures through 2026. The strike may lead to a downgrade if Boeing's liquidity deteriorates significantly or if it fails to generate sufficient free cash flow, which remains constrained through 2025 due to production challenges and cost pressures.

The last time Boeing machinists went on strike was September 7, 2008. At the time, the strike was over job security, outsourcing, pay, and benefits. This caused a $1.2 billion hit to the company's net income. This could be much more costly today.

"The strike will impact production and deliveries and operations and will jeopardize our recovery," CEO Brian West told investors at a Morgan Stanley conference Friday.

Boeing is set to lose its prized investment-grade rating, which has been cited in every quarterly earnings presentation.

West said, "We are also considering the difficult step of temporary furloughs for many employees, managers and executives in the coming weeks."

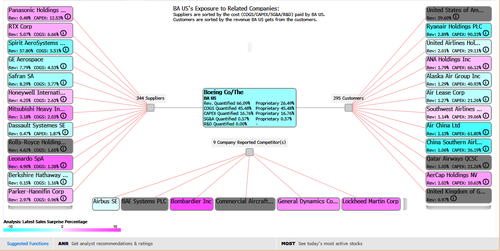

What's emerging for Boeing is the downstream effects of strikes. That includes a reduction in spending on suppliers, and by the way, Boeing's website says there are 11,000 active suppliers worldwide, which could trigger layoffs and disruptions across its supplier network.

Using Bloomberg data, here are some of Boeing's top suppliers:

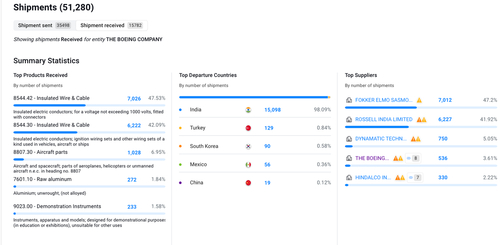

According to risk management firm Sayari Labs, the latest Boeing shipments primarily come from India, Turkey, South Korea, Mexico, and China. Suppliers in these regions are likely to be the most impacted.

That's a lot of suppliers.

If Boeing's supplier network was to experience throttling and or shutdowns on a prolonged strike, then how long would it take to get the supplier network back to full capacity?