Authored by Metals Focus via Money Metals,

Last week, Metals Focus attended the China Silver and Photovoltaic Industry Chain Seminar in Wuxi. During this event, our research consultant, Elvis Chou, presented on the outlook for the silver market, including the photovoltaic (PV) sector.

As has been widely reported, the PV market has undergone substantial changes over the past decade, with the industry’s expansion significantly boosting demand for silver.

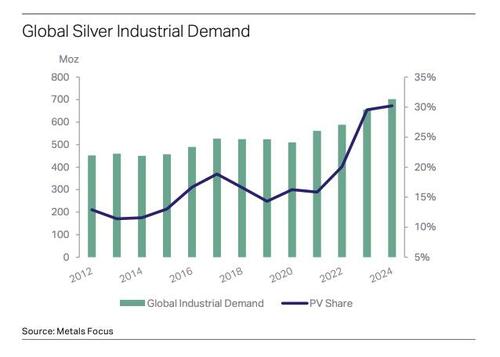

As a reminder, in World Silver Survey 2024 Metals Focus reported a 64% y/y surge in silver PV offtake to a record total of 6,017t (193Moz). However, with technological progress and market fluctuations, it is important to examine if this trend will continue, or if new dynamics will emerge, laying out a different path for this sector.

Following the dramatic surge in installed capacity over the last two years, which reached 444GW last year against 182GW in 2021, the PV sector has achieved a substantial base level of demand.

However, taking into account several developments, including global cuts in solar energy bid prices, increased financing costs, fewer government subsidy projects, and diminishing investment returns, it is widely anticipated that the industry’s expansion will start to moderate.

That said, the H1 performance indicates that, except for Europe, solar installations in other major markets, including China, India, the US, the Middle East and Africa, all increased, reflecting a positive trend in solar adoption across these locations.

However, what also emerged were indications of a somewhat slower pace of installations as the first half progressed. This prompted an immediate reaction from the supply chain, which initially scaled back production and has continued to manage output in Q3.

As a result, this quarter is experiencing a slower-than-expected peak season, which in turn has introduced some uncertainty in trying to project demand for the latter half of the year. The somewhat cautious outlook for PV demand in the coming months has also intensified competition within the supply chain, which is already dealing with surplus capacity, resulting in weaker module prices.

For instance, in China in Q3.23 the bidding price (how much the government pays for power from a new project) was RMB 1.6-1.7 per watt, but this has plummeted to RMB 0.7 per watt this September. This means that most panel and module manufacturers are now losing money. To help address this these companies are increasingly focusing on enhancing product efficiency and reducing costs.

As part of this strategy, N-type solar cells (which covers TopCon and HJT), known for their superior efficiency, have emerged as the market’s dominant technology this year (as widely expected). The initial market perception was that, with the increasing popularity of N-type cells, the growth in silver consumption would exceed that of installations, due to their higher silver loadings compared to P-type cells, like PERC.

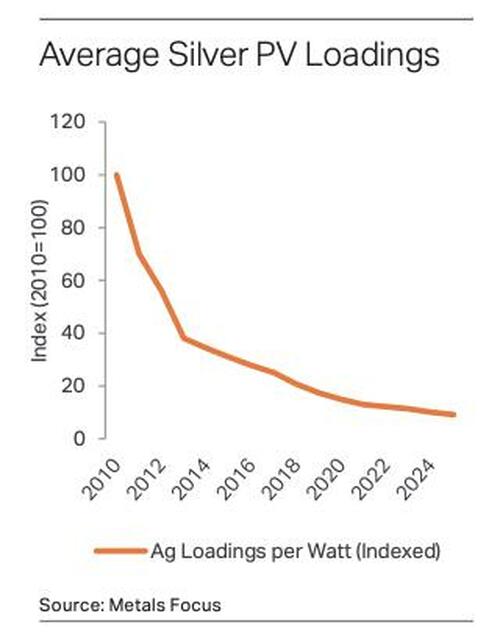

Contrary to these expectations, our field research revealed that Chinese producers have made more progress in thrifting and substitution than previously anticipated. Since the beginning of this year, each quarter the industry has reduced the amount of silver paste that is applied to a panel by roughly 4-5% compared with the previous quarter.

This has been achieved through a series of improvements, notably: upgrading production processes to increase efficiencies and shrink line width by introducing Laser Enhance Contact Optimisation (LECO); optimising the structural design by transitioning from Super Multi-BusBar (SMBB) to Zero-BusBar (0BB) conductive lines, and introducing some silver coated copper powder.

As a result, we expect silver usage per watt to drop by 10-15% y/y in 2024. And so, with this cost-cutting roadmap in place, leading panel and module producers have effectively reduced the proportion of silver as a share of the total module cost to less than 10%. This in turn has helped to cushion the effects of elevated and volatile silver prices.

Additionally, to protect themselves against further gains in the silver price, these companies are looking to implement further cost reductions well into 2025.

As the single largest application for silver in the industrial sector, accounting for more than 30% of global silver industrial offtake, PV has had a profound impact on global silver supply chains.

Despite the above headwinds, we still expect the sector to consume around 6,600t (212Moz) of silver this year, a new high. Considering the huge potential for expansion in the green energy space, we believe that solar energy will remain pivotal in the industrial silver market in the coming years.

However, the worldwide deployment of solar systems is encountering several obstacles that could hinder its growth, including the capacity of the underlying power grid, the impact of land utilization, and challenges associated with panel recycling.

Therefore, as newly added capacity broadly stabilizes, albeit at record highs, further cuts to silver loadings may exceed the growth rate of installations, potentially leading to a slightly softer trend in total silver consumption. Even so, this should not detract from the fact that silver PV demand will remain historically high and so retain its position as the largest single end-use of global silver industrial demand.

Metals Focus is a London-based independent precious metals consultancy specializing in gold, silver, platinum, palladium, and rhodium markets. They offer research, consultancy, and bespoke services, producing reports like Precious Metals Weekly and World Silver Survey. Their global team spans key markets, including the UK, Singapore, Mumbai, and Shanghai, providing industry insights for professionals, investors, and governments.