Warren Buffett's ongoing liquidation of his Bank of America stake comes right before the Federal Reserve's expected start of the interest rate-cutting cycle in mid-September. Additionally, Buffett has halved his Apple holdings and amassed a record amount of cash. At 93, it seems the billionaire investor is bracing for a rough patch in the US economy.

Buffett's Berkshire Hathaway has been on a six-week selling spree of Bank of America shares, trimming its entire position by nearly 13% and generating upwards of $5.4 billion in proceeds, according to Bloomberg. Berkshire's latest filing shows that since last Monday, another $982 million worth of shares were sold.

Bloomberg data shows Berkshire has dumped more than 129 million BofA shares in the last six weeks.

Berkshire remains the bank's largest stockholder, with 903.8 million shares, worth about $36 billion, as of Tuesday's closing price. However, the position's size has fallen to early 2019 levels.

Berkshire's selling was abrupt and without reason. The wave of selling began in mid-July around and above the $40 handle.

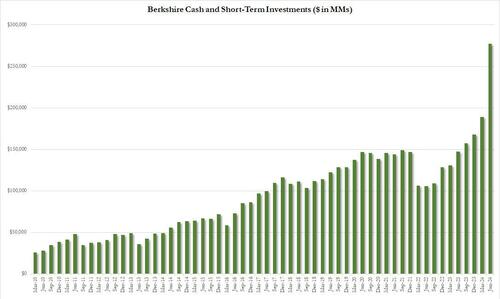

In addition to the BofA selling, Berkshire dumped half its Apple shares and other securities, sending its cash pile soaring by a record $88 billion to an all-time high of $277 billion at the end of the second quarter.

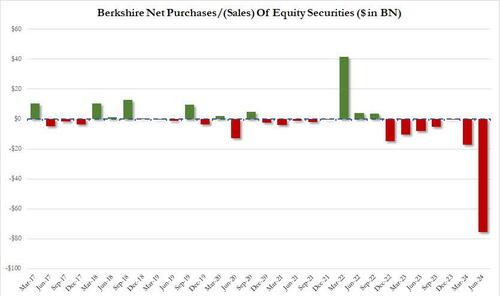

As shown in the chart below, in the second quarter (which ended June 30, and thus just two weeks after the Apple's Developer Conference which took place on June 10 and which was - at least on the day of - a total bust), Berkshire sold a net $75.5 billion worth of stock, the bulk of which we now know, came from Buffett's liquidation of half his Apple shares.

It's hardly a surprise why Buffett has been dumping equities and raising record amounts of cash - as we noted in "Berkshire's Growing Cash Pile Has A Hidden Message On Stocks," the Buffett Indicator has rarely signaled a more expensive market.

Back to BofA, maybe Buffett's reason for selling BofA is correctly pointed out by WSJ: "If the Fed were to make three quarter-point cuts before the end of the year, the bank expects its quarterly net interest income would be lower by roughly $225 million in the fourth quarter from the second quarter."