In yet another indication that the bottom for oil prices is in, and following a similar move last week by Morgan Stanley whose actions have been a rock-solid contrarian indicator in the past...

... overnight Goldman's commodity analyst - now without "supercycle" permabull Jeff Currie - Daan Struyven slashed his expected range for Brent oil prices by $5 to $70-$85 per barrel, citing weaker Chinese oil demand, high inventories, and rising U.S. shale production, but the biggest driver for the cut is his belief that "OPEC will raise production in Q4 as the market is potentially shifting from an equilibrium where OPEC supports spot balances and reduces volatility to a more long-run equilibrium focused on strategically disciplining non-OPEC supply and supporting cohesion."

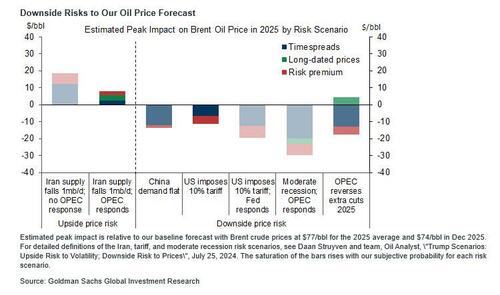

“Prices could significantly undershoot in the short term, especially if OPEC were to strategically discourage US shale growth more forcefully, or if a recession were to reduce oil demand,” the bank’s analysts noted, referring to a scenario in which Brent could trade lower than its price forecast.

That, we can assure the Goldman analyst, will not happen.

According to the Goldman note which is available to pro subscribers in the usual place, OECD commercial inventories have been stable contrary to expectations of summer draws for two reasons:

- First, US liquids supply is beating expectations on ongoing efficiency gains and a 0.7mb/d YoY surge in NGL supply.

- Second, China demand growth has slowed on structural road fuel switching and on petrochemical demand weakness.

Yet despite what he believes will be higher US supply and lower China demand growth (oddly enough, nobody talks about India which is rapidly becoming the biggest swing factor on the demand side), Goldman looks for oil prices "to decline only modestly in 2025" for two reasons:

- Solid OECD and India demand limits the uptick in our 2025 surplus forecast to 0.6mb/d (vs. 0.5mb/d).

- Second, lower interest rates and a normalization in valuation should limit downward price pressure.

As a result, the bank has "nudged" down its fair value estimate for Brent by $2/bbl to $70/bbl following efficiency gains from US shale producers, an upgrade in peak production on the GS Top Projects curve, and our view that cheaper global natural gas from 2026 will reduce oil demand growth.

That said, the bank warns of downside risk to prices and upside risk to volatility: "The risks to our $70-85 range skew to the downside given high spare capacity, potential trade tensions, and the possibility that OPEC may fully reverse the extra cuts in 2025." While US shale breakeven Brent prices around $70 provide the long-run floor under Brent, prices could undershoot in the short-term; therefore, Goldman sees upside risk to oil implied volatility as short-term inventory volatility may pick up with OPEC's focus on long-run balance; geopolitical conflicts remain unresolved; Iran supply may fall; and current market pricing of volatility remains low.

As noted above, Morgan Stanley has also recently revised its oil price forecasts downward, reflecting expectations of increased supply from OPEC and non-OPEC producers amid signs of weakening global demand. The bank now anticipates that while the crude oil market will remain tight through the third quarter, it will begin to stabilize in the fourth quarter and potentially move into a surplus by 2025.

Morgan Stanley has cut its forecast for the fourth quarter to $80 per barrel, down from $85, and now expects prices to gradually decline to $75 per barrel by the end of 2025, slightly lower than their previous estimate of $76.

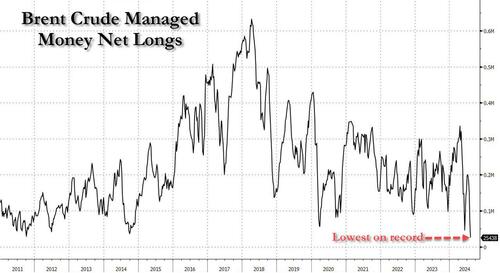

None of this is new to the market, where sentiment is downright apocalyptic and as noted two weeks ago, bullish positioning in oil just hit an all-time low...

... which naturally means, that the most likely direction for prices from this point onward is higher...

More in the full note available to pro subs in the usual place.