Authored by John Rubino via Substack,

Pretend, for a moment, that it’s 1971 and you’re President Richard Nixon (admittedly disturbing fantasies, but bear with me). You face the perennial government income/outflow dilemmas, and other countries, noting your struggle, are trying to cash their dollars in for your limited pile of gold bars.

But this time around you don’t cave and “close the gold window,” ushering in the Age of Fiat Currencies. Instead, you cut spending and raise revenues however you have to. You balance your budget and convince your trading partners that the dollar remains “good as gold.”

Thanks to you, the US and by extension the world remains on the post-WW II Bretton Woods quasi gold standard. And what follows is very different.

But how different, exactly? How would a sound-money world depart from the financial train wreck that we’ve come to accept as the new normal?

One way to find out is to calculate asset prices in terms of gold rather than dollars and see what kind of price action the past half-century would have experienced under a gold standard.

Stocks: Only Dividends Matter

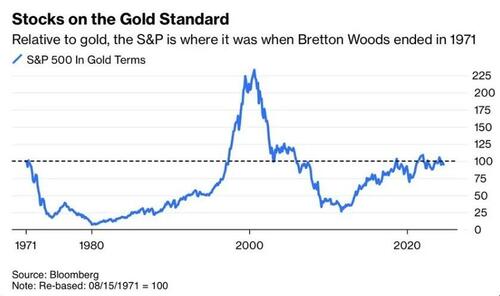

Let’s start with stocks. When valued in real money (i.e., gold) the S&P 500 is virtually unchanged since 1971. The following chart ignores the dividends paid by public companies, so let’s give stocks a positive real return of maybe 2% a year, all of it from profitable companies returning cash to shareholders.

Share prices still rise and fall, but the fluctuations are more muted and less disruptive than the serial bubbles of the past five decades.

GDP: The Long Depression?

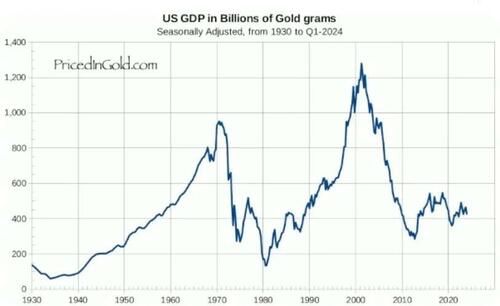

When priced in gold, the US economy (measured by gross domestic product, or GDP) is actually smaller than it was in 1971, giving credence to the people who claim we’ve been in a “capital D” depression since 2000 if not 1971.

Oil: Life Keeps Getting Cheaper

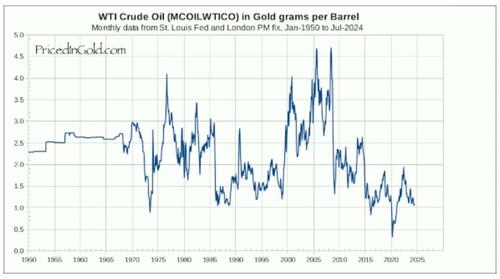

As the saying goes, “energy is life, life is energy.” In dollar terms, oil and its distillates like gasoline are far more expensive these days, as is life in general. But priced in gold, oil is actually down by almost two-thirds since 1971.

In our hypothetical gold standard world, energy is making life easier and more manageable instead of harder and more stressful.

Houses: Our Kids Get Their Starter Home

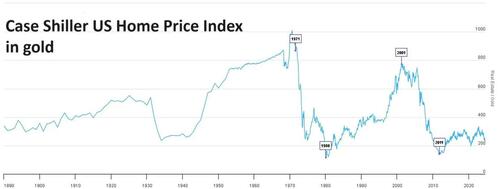

Housing might be the part of life where inflation has been most debilitating, with two entire generations now priced out of home ownership. What would it be like under a gold standard? US houses would be about as cheap as they’ve been in the past century.

Rents would be lower, and our kids and grandkids would own their own homes rather than renting (or staying with us).

Life In a Sound Money World

What a difference a single policy decision can make. Had the US just gotten its act together in the 1970s and maintained sound money, today we’d be buying stocks for their 2% dividend yield rather than betting our life savings on never-ending boom/bust cycles. We (and more important, our kids) would be living in affordable houses. We’d have no trouble filling the gas tank to get to work. And the Aristocracy wouldn’t be feasting on the peasants and shredding the fabric of society.

A gold-standard world would, in short, be a saner and more sustainable place in which we’d be a lot less worried about the chaos to come.