With the market suddenly freaking out about a full-blown hard landing recession - at least until tomorrow's goalseeked jobs data comes in 3-sigma higher than expectations to prove just how strong Kamalanomics truly is - and the all-important semiconfuctor sector swinging from a 7% gain to a 7% loss in the span of two days, not to mention all of yesterday's Nasdaq gains (and then some) gone, today's earnings from AAPL and AMZN are the last remaining hope to prevent a historic Mag 7 rout (especially with Nvidia not set to report for weeks).

So what to expect from the two gigacaps when they report and how are markets positioned into their earnings. We start with Amazon...

What To Look For When Amazon Reports Earnings

Amazon is the top long within Mega Cap Tech, but crowding has changed a bit given the selloff last week. According to UBS, the investment thesis continues to be driven by e-commerce share, margin expansion and the potential for AWS growth recovery through the year. Investors are also looking for signals of ROIC on the incremental capex since Amazon didn't talk about the intended step up in capex for AWS, except to say that it will step up. The capex amount this quarter will be more closely watched as an indicator of AWS demand to come.

Despite the recent acceleration, AWS revenue growth is still not back to the 1H22 levels, just before the period of cloud-spend optimization efforts and slower new workload growth began. The Street consensus growth rate estimate for AWS growth in 2Q24 is 17% (UBS estimate is slightly lower at 16%) and the investor growth bogey is 18%, a one-point sequential acceleration. 2Q24 represents a 4-point easier compare and AWS growth of 18% implies 2Q24 AWS sequential revenue growth of $1.1 billion, well above the 2Q23 (depressed) level of $786 mn but still below 2Q22 sequential growth of $1.3 bn. While not a slam dunk, the investor AWS growth bogey of 18% looks doable if AI revenues ramp up and core-cloud spending is stable.

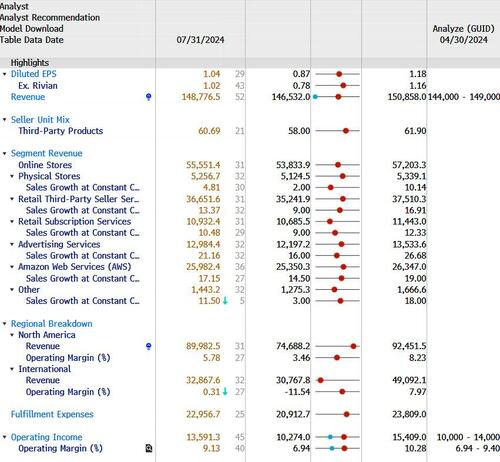

According to JPM tech trader Jack Atherton, AWS growth needs to be 18%+ for Q2 with path to Q3 acceleration. His buyside survey pointed to Q2 net sales ~$149.4B, EBIT $15.1B (both slightly above top end of guides); Q3 guidance of net sales $155-161B, EBIT $13-17B.

Looking beyond the 2Q24 quarter, investors are debating whether AWS revenue growth can continue to accelerate towards 20% by year-end 2024. The most important things will be:

- directional commentary around AWS growth/optimization;

- signals of retail margin improvement as suggested by management commentary on “cost to serve”;

- progress with fulfillment regionalization and broader cost containment efforts,

- directional commentary on fiscal year capex for ecommerce (up with business) and ongoing AWS investments,

- commentary on adoption of Prime Video with ads and ad industry broadly, and 6) positioning around GenAI investments.

Bogeys:

- Q2 Total Sales: $149-150 bn

- Q2 EBIT: $14 bn+

- Q2 AWS Growth: 18%

- Q3 Total Sales: guide high end of the Street at $158 bn

- Q3 EBIT: $15 bn+ (freight rate dynamic)

And a detailed breakdown of expectations:

* * *

What about Apple? Here sentiment is as bullish as ever into earnings

According to UBS, Apple sentiment is a 9/10, same as AMZN, with hedge funds as bullish as ever as the stock repeatedly and successfully fights off any not-so-rosy data point to come its way (Vision Pro ’24 outlook slashed, UBS analyst Dave Vogt’s analysis suggesting that the company once again lost share to Chinese vendors), rising to all-time highs with bulls full steam ahead on the iPhone 16/AI opportunity, even without any concrete evidence.

Dave continues to take a more skeptical stance in regard to the iPhone AI refresh thesis (echoed by AT&T and Verizon earnings calls this week) as the phone will likely require more sophisticated features to ignite one. That said, even the UBS analyst is surprised at the level of pushback on such a stance as bulls continue to believe the market is underestimating just how old the installed base is (it may be, but a glorified siri is absolutely no reason to get an updated one). That all said, there is nothing out of Dave’s checks that would call for a beat/miss this quarter, although all eyes are on the FY25 outlook, where he views iPhone expectations as too rosy.

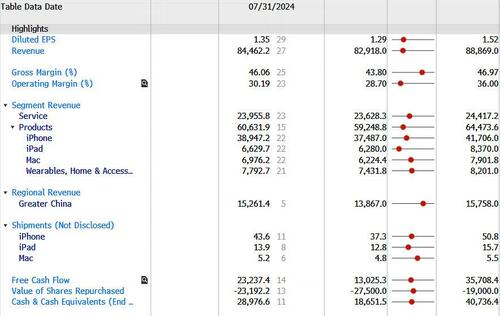

Bogeys:

- Q3 Total Sales: $85bn

- Q3 gross margin 46%

- Q3 operating margin 30%

Positioning/Flows: UBS has been a better buyer from Long Onlys and Hedge Funds alike. Most investors seem to be looking through this quarter and giving Apple the benefit of the doubt around a successful/improving iPhone 16 upgrade cycle and remain long until further notice.