In 2024, the median salary for the typical American home buyer has risen to $104,339 - up from $88,000 just two years prior.

Despite record-high home prices, housing demand continues to outpace supply, even with mortgage rates at their highest in over a decade. As one bright spot, housing inventory is steadily increasing, with the number of homes for sale up almost 19% in May compared to the previous year. This growth in inventory could help ease the cost of home ownership looking ahead.

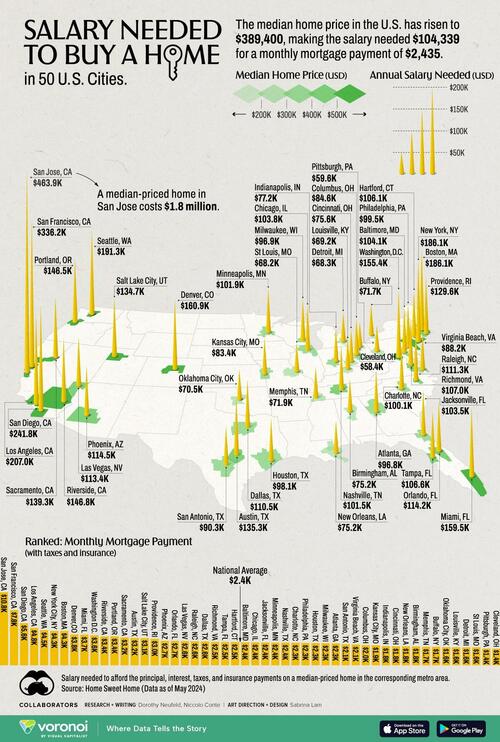

This graphic, via Visual Capitalist's Dorothy Nuefeld, shows the salary needed to buy a home across the 50 largest U.S. metropolitans in 2024, based on data from Home Sweet Home.

Below, we rank U.S. metro areas based on the salary needed to buy a median-priced home.

| 2024 Ranking | Metro Area | State | Median Home Price | Salary Needed |

|---|---|---|---|---|

| 1 | San Jose | California | $1,840,000 | $463,886.5 |

| 2 | San Francisco | California | $1,300,000 | $336,170.4 |

| 3 | San Diego | California | $981,000 | $241,783.5 |

| 4 | Los Angeles | California | $823,000 | $207,030.2 |

| 5 | Seattle | Washington | $755,300 | $191,332.4 |

| 6 | New York City | New York | $659,200 | $186,122.8 |

| 7 | Boston | Massachusetts | $704,700 | $186,058.7 |

| 8 | Denver | Colorado | $651,000 | $160,874.3 |

| 9 | Miami | Florida | $625,000 | $159,528.2 |

| 10 | Washington, D.C. | N/A | $600,200 | $155,370.4 |

| 11 | Riverside/ San Bernardino |

California | $579,900 | $146,791.9 |

| 12 | Portland | Oregon | $574,000 | $146,483.4 |

| 13 | Sacramento | California | $533,900 | $139,283.1 |

| 14 | Austin | Texas | $466,700 | $135,333.1 |

| 15 | Salt Lake City | Utah | $551,200 | $134,691.8 |

| 16 | Providence | Rhode Island | $470,700 | $129,565.5 |

| 17 | Phoenix | Arizona | $470,500 | $114,499.6 |

| 18 | Orlando | Florida | $435,000 | $114,215.9 |

| 19 | Las Vegas | Nevada | $465,400 | $113,354.8 |

| 20 | Raleigh | North Carolina | $439,800 | $111,347.6 |

| 21 | Dallas | Texas | $377,700 | $110,463.0 |

| 22 | Richmond | Virginia | $425,000 | $106,952.9 |

| 23 | Tampa | Florida | $405,200 | $106,614.1 |

| 24 | Hartford | Connecticut | $350,400 | $106,127.9 |

| 25 | Baltimore | Maryland | $385,000 | $104,132.8 |

| 26 | Chicago | Illinois | $349,300 | $103,794.0 |

| 27 | Jacksonville | Florida | $390,000 | $103,487.6 |

| 28 | Minneapolis | Minnesota | $373,500 | $101,868.4 |

| 29 | Nashville | Tennessee | $404,300 | $101,535.4 |

| 30 | Charlotte | North Carolina | $398,300 | $100,140.4 |

| 31 | Philadelphia | Pennsylvania | $342,500 | $99,535.4 |

| 32 | Houston | Texas | $334,100 | $98,135.3 |

| 33 | Milwaukee | Wisconsin | $354,000 | $96,942.7 |

| 34 | Atlanta | Georgia | $369,200 | $96,825.1 |

| 35 | San Antonio | Texas | $305,800 | $90,259.9 |

| 36 | Virginia Beach | Virginia | $336,500 | $88,208.3 |

| 37 | Columbus | Ohio | $306,600 | $84,598.5 |

| 38 | Kansas City | Missouri | $308,600 | $83,386.1 |

| 39 | Indianapolis | Indiana | $300,100 | $77,181.6 |

| 40 | Cincinnati | Ohio | $280,600 | $75,634.6 |

| 41 | New Orleans | Louisiana | $277,700 | $75,218.3 |

| 42 | Birmingham | Alabama | $295,000 | $75,193.9 |

| 43 | Memphis | Tennessee | $272,400 | $71,943.2 |

| 44 | Buffalo | New York | $229,700 | $71,669.2 |

| 45 | Oklahoma City | Oklahoma | $251,000 | $70,455.8 |

| 46 | Louisville | Kentucky | $262,000 | $69,169.8 |

| 47 | Detroit | Michigan | $240,000 | $68,334.7 |

| 48 | St Louis | Missouri | $241,100 | $68,240.0 |

| 49 | Pittsburgh | Pennsylvania | $207,100 | $59,604.2 |

| 50 | Cleveland | Ohio | $191,900 | $58,402.6 |

| National | $389,400 | $104,339.0 |

Note: These calculations determine the salary needed to afford the principal, interest, taxes, and insurance payments on a median-priced home in the corresponding metro area as of May 2024. Figures reflect homes with a 30-year fixed-rate mortgage and a 20% down payment.

As the most expensive city overall, residents in San Jose require a salary of $463,887 for a median-priced home in 2024—more than quadruple the national average.

Since 2023, this required salary has skyrocketed almost $100,000, soaring to a monthly payment of $10,824 to own a home. One reason why San Jose prices are sky-high: it sits at the heart of Silicon Valley. On average, homes on the market sell in roughly nine days.

Like San Jose, the San Francisco metro area is highly unaffordable. In May, median home prices stood at $1.3 million. The metro area houses more billionaires than anywhere in the world, in addition to having among the most individuals with $100 million in investable wealth globally.

New York City residents need an annual salary of $186,123, making it the sixth-highest in the country. While the annual growth in home prices fell into negative territory, the required salary to own a home jumped over $25,000 since last year. Overall, just 30% of New Yorkers own homes, compared to the 66% national average.

On the other hand, Cleveland, Pittsburgh, and St. Louis are the most affordable metro areas in the dataset, where a salary under $70,000 can buy a median-priced home.