Authored by Lance Roberts via RealInvestmentAdvice.com,

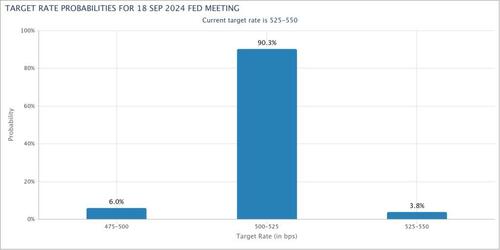

With both economic and inflation data continuing to weaken, expectations of Fed rate cuts are rising. Notably, following the latest consumer price index (CPI) report, which was weaker than expected, the odds of Fed rate cuts by September rose sharply. According to the CME, the odds of a 0.25% cut to the Fed rate are now 90%.

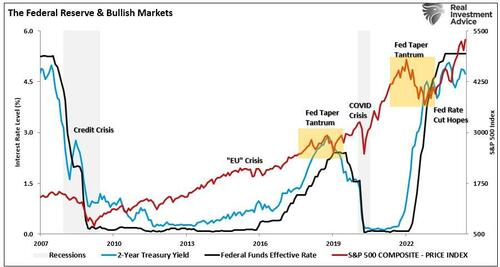

Since January 2022, the market has repeatedly rallied on hopes of Fed cuts and a return to increased monetary accommodation. Yet, so far, each rally eventually failed as economic data kept the Federal Reserve on hold.

However, as noted, the latest economic and inflation data show clear signs of weakness, which has bolstered Jerome Powell’s comments that we are nearing the point where Fed rate cuts are warranted. To wit:

“Major indexes rose as Federal Reserve Chair Jerome Powell spoke to a House committee after his first day of congressional testimony on Tuesday inched the Fed closer to lowering interest rates. In his testimony this week, Powell pointed to a cooling labor market and suggested that further softening might be unwelcome.”

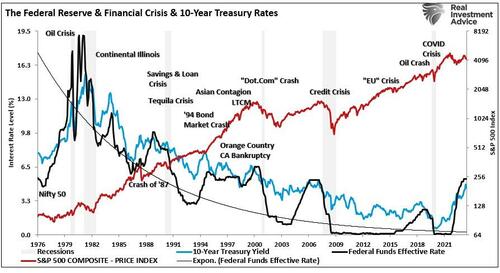

Following those comments, the financial markets cruised to new highs. This is unsurprising since the last decade taught investors that stocks rally when the Fed “eases” financial conditions. Since 2008, stocks are up more than 500% from the lows. The only exceptions to that rally were corrections when the Fed was hiking rates.

Given recent history, why should investors not expect a continued rally in the stock market when Fed rate cuts begin?

Fed Rate Cuts And Market Outcomes

One constant from Wall Street is that “buy stocks” is the answer no matter what the question. Such is the case again as Fed rate cuts loom. The belief, as noted, is that rate cuts will boost the demand for equities as yields on short-term cash assets fall. However, as Michael Lebowitz pointed out previously in “Federal Reserve Pivots Are Not Bullish:”

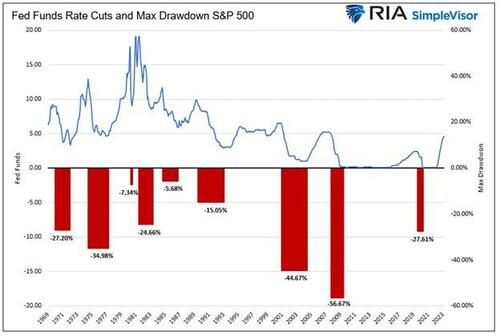

“Since 1970, there have been nine instances in which the Fed significantly cut the Fed Funds rate. The average maximum drawdown from the start of each rate reduction period to the market trough was 27.25%.

The three most recent episodes saw larger-than-average drawdowns. Of the six other experiences, only one, 1974-1977, saw a drawdown worse than the average.”

Given that historical perspective, it certainly seems apparent that investors should NOT anticipate a Fed rate-cutting cycle. There are several reasons why:

-

Rate cuts generally coincide with the Fed working to counter a deflationary economic cycle or financial event.

-

As deflationary or financial events unfold, consumer activity contracts, which impairs corporate earnings.

-

As corporate earnings decline, markets must reprice current valuations for lower earnings.

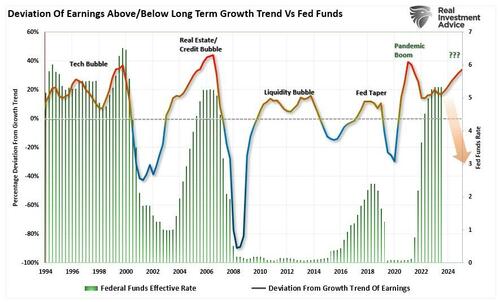

The chart below shows corporate earnings’ deviation from long-term exponential growth trends. You will note that the earnings deviation reverts when the Fed cuts rates. Therefore, while analysts are optimistic about earnings growth going into 2025, a Fed rate-cutting cycle will likely disappoint those expectations.

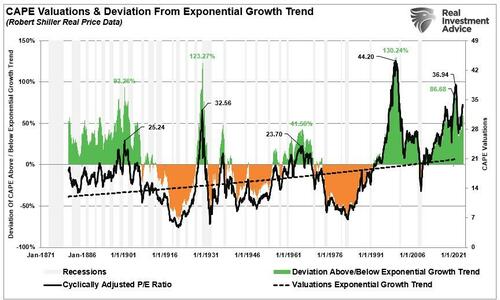

More interestingly, the worse the economic data is, the more bullish investors have become in their search for that policy reversal. Of course, as noted, weaker economic growth and lower inflation, which would coincide with a rate-cutting cycle, do not support currently optimistic earnings estimates or valuations that remain well deviated above long-term trends.

Of course, that valuation deviation directly resulted from more than $43 Trillion in monetary interventions since 2008. The consistent support of any market decline trained investors to ignore the fundamental factors in the short term. However, as the Fed cuts rates to stave off a disinflationary or recessionary environment, the collision of economic realities with optimistic expectations has tended to turn out poorly.

Time To Buy Bonds?

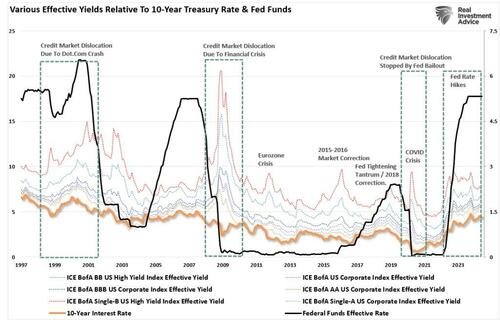

One asset class stands out as an opportunity for investors to shelter during a Fed rate-cutting cycle: Treasury bonds. Notably, we are discussing U.S. Government Treasury bonds and not corporate bonds. As shown, during disinflationary events, economic recessions, and credit-related events, Treasury bonds benefit from the flight to safety, while corporate bonds are liquidated to offset default risks.

As stock prices fall during the valuation reversion proceeds, investors tend to look for a “safe harbor” to shelter capital from declining values. Historically, the 10-year Treasury bond yield (the inverse of bond prices) shows a very high correlation to Federal Reserve rate changes. That is because while the Fed controls the short end of the yield curve, the economy controls the long end. Therefore, longer-term yields respond to economic realities as the Fed cuts rates in response to a disinflationary event.

Could this time be different? Sure, but you are betting on a lot of historical evidence to the contrary.

While the hope is that the Fed will start dropping interest rates again, the risk skews toward stocks. As noted, the only reason for Fed rate cuts is to offset the risk of an economic recession or a financially related event. The “flight to safety” will cause a rate decline in such an event. The previous rise in rates equated to a 50% reduction in bond prices. Therefore, a similar rate reversion could increase bond prices by as much as 70% from current yields.

In other words, the most hated asset class of the last two years may perform much better than stocks when the Fed cuts rates.

Therefore, as we approach the first Fed rate cut in September, it may be time to consider reducing equity risk and increasing exposure to Treasury bonds.