Authored by Mike Maharrey via Money Metals,

Silver use by the solar energy sector is one of the primary factors driving the overall demand for silver, and there is reason to believe photovoltaic silver off-take will continue to increase in the years ahead.

Not only is the demand for silver panels growing, but the amount of silver used in each panel is also increasing.

Industrial demand for silver set a record of 654.4 million ounces in 2023 and it is expected to hit new highs this year. According to the Silver Institute, ongoing structural gains from green economy applications underpinned this surge in silver demand.

"Higher than expected photovoltaic (PV) capacity additions and faster adoption of new-generation solar cells raised global electrical & electronics demand by a substantial 20 percent. At the same time, other green-related applications, including power grid construction and automotive electrification, also contributed to the gains."

Silver is the best conductor of electricity of all metals at room temperature. That makes it a vital input in the production of solar panels.

To manufacture a solar panel, silver is formed into a paste that is applied to the front and back of silicon photovoltaic cells. The front side collects the electrons generated when sunlight strikes the cell, while the back side helps to complete the electrical circuit.

Each solar panel uses approximately 20 grams (0.643 ounces) of silver. While this is a relatively small amount, the total adds up quickly when you consider the number of panels produced each year. The solar industry used approximately 100 million ounces of silver in 2023, accounting for about 14 percent of total silver demand.

Several years ago, analysts assumed that the amount of silver used in solar panels would decline over time with the development of new technologies. However, a Saxo Bank report in 2020 disputed this claim, saying, “Potential substitute metals cannot match silver in terms of energy output per solar panel.”

“Further, due to technical hurdles, non-silver PVs tend to be less reliable and have shorter lifespans, presenting serious issues for their widespread commercial development.”

It turns out, this analysis was correct. Newer more efficient technologies use 20 to 120 percent more silver.

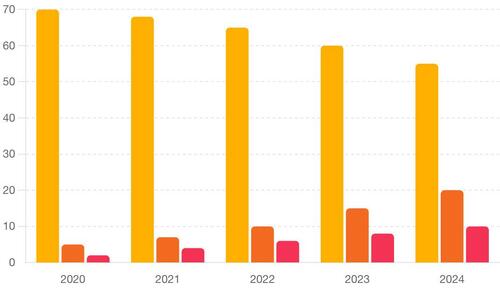

In 2020, Passivated Emitter and Rear Cell (PERC) technology was the standard, accounting for virtually the entire solar market. A PERC solar panel uses about 10 milligrams of silver per watt.

By 2022, PERC technology was being replaced by Tunnel Oxide Passivated Contact (TOPCon) cells. This advanced technology enhances the efficiency of solar cells by improving the way they handle electron flow. A TOPCon cell is cheaper to produce but uses more silver than a PERC solar panel. It contains about 13 milligrams of silver per watt.

Now, heterojunction (HJT) technology is beginning to dominate the solar market. HJT cells are even more efficient than TOPCon technology and can capture energy on both sides of the panel. They are also more environmentally friendly. But they use even more silver – about 22 milligrams per watt. HJT cells only made up a small part of the market in 2023, but demand for these more efficient panels is expected to grow.

With demand for solar power increasing along with the amount of silver used in each panel, analysts believe that solar panel production will consume increasingly large amounts of silver in the future.

According to a research paper by scientists at the University of New South Wales, solar manufacturers will likely require over 20 percent of the current annual silver supply by 2027.

By 2050, solar panel production will use approximately 85–98 percent of the current global silver reserves.

The green energy sector is also essentially recession-proof because it is being driven, incentivized, and in some cases directly funded by governments around the world.

The silver market is already running significant deficits with silver demand outstripping supply. The structural deficit in 2023 came in at 184.3 million ounces.

While there is still a large silver stock available, market deficits will eventually deplete the reserve of available metal. We could see a significant supply squeeze in the coming years.

Silver is not currently priced for these supply and demand dynamics.

It’s also important to remember that while industrial demand is an important factor driving the price, silver is still fundamentally a monetary metal. As such, the price tends to track with gold over time. If you are bullish on gold, you should be even more bullish on silver. In fact, silver tends to outperform gold in a gold bull market.

Given the supply and demand dynamics, the economic environment, and a historically wide gold-silver ratio that indicates silver is underpriced, there are plenty of reasons to think silver will shine in the future.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.