Elon Musk has said that a purpose-built robotaxi will be the centerpiece of his long-term strategy for Tesla.

In about two months, on August 8, Musk is set to unveil the 'Robotaxi,' potentially positioning Tesla to compete with some of the largest ride-hailing services. However, before these robotaxis flood city streets and highways, Tesla must first solve full autonomous driving mode.

Tesla has yet to announce a timeline for the Robotaxi or Full Self-Driving (FSD) with no intervention.

Musk recently said that future FSD versions are getting so accurate that "it is starting to get to the point where, once known bugs are fixed, it will take over a year of driving to get even one intervention."

Tesla's latest FSD version (Full Self-Driving v12.4.1) has become more refined ahead of the robotaxi unveiling event.

At the recent JPMorgan European Automotive Conference in London, analysts from the bank, led by Ryan Brinkman, wrote in a note on Tuesday about a conversation with Tesla's Director of Investor Relations, Travis Axelrod.

Brinkman provided clients with a seven-point bullet list highlighting the most critical topics discussed:

The next wave of the company's growth will be led by the introduction of lower cost models expected in force by 2025 which utilize existing platforms and assembly lines rather than the earlier planned next-generation platform, suggesting the potential for less near-term reduction in COGS but also significant capital savings;

Augmenting the re-acceleration of unit volume growth next year is expected to be continued strong growth in energy storage and services, and autonomy becoming a more meaningful contributor;

Nothing has changed with regards to the company's ambitious long-term volume targets;

Ratification of CEO Elon Musk's 2018 compensation plan at a shareholder meeting later this week was said in our meetings to be important in allowing the company to refocus on operational goals by putting the corporate governance issue behind it and because it would allow Mr. Musk to remain comfortable pursuing "real world AI" opportunities within Tesla;

Mr. Musk's creation of a separate vehicle (xAI) to pursue more generalized or language model artificial intelligence opportunities outside of Tesla was said to not conflict with the automaker's more robotics focused AI efforts;

Management continues to believe in the superiority of its vision-only based approach to Full Self-Driving, believing it to be by far the lowest cost and most scalable way forward;

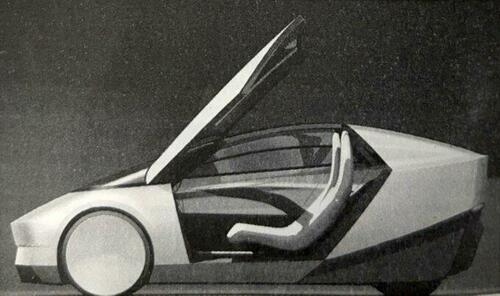

Because Tesla expects varying degrees of interest on the part of customers when it comes to placing their private vehicles on a public robo- taxi network, it expects to augment this supply with a dedicated robo-taxi vehicle which will offer cost and utility advantages relative to a traditional consumer vehicle (the expected basing of this dedicated robo-taxi on Tesla's delayed next- generation platform in our view implies timing could be some years away).

Brinkman provides highlights from the conversation on robotaxi. The biggest takeaway is that the analyst doesn't believe there will be material revenue generation from these taxis "for years to come."

-

Tesla's Response: Management continues to believe in the superiority of its vision- only based approach to Full Self-Driving, believing it to be by far the lowest cost and most scalable way forward. Because Tesla expects varying degrees of interest on the part of customers when it comes to placing their private vehicles on a public robo- taxi network, it expects to augment this supply with a dedicated robo-taxi vehicle which will offer cost and utility advantages relative to a traditional consumer vehicle. The expected basing of a dedicated robo-taxi on Tesla's next-generation platform in our view implies timing could be some years away.

-

IR clarified that Tesla's Full Self Driving (FSD) offering today is an (exceptionally capable) Level 2 system requiring close driver supervision but which it hopes for all vehicles built since 2016 equipped with the requisite hardware to eventually evolve via a software update into a Level 5 (non- geofenced) entirely unsupervised system capable of scaling in virtually any jurisdiction. Management continues to believe that this can be accomplished via vision sensing alone, similar to how human drivers can adequately operate a vehicle with "two cameras attached to the front of their heads" (their eyes) accompanied by a "neural network" (their brain).

-

IR clarified, too, that it has all along intended to pursue a two-pronged approach in which its planned robo-taxi network could be operated with a combination of customer provided vehicles as well as a dedicated robo-taxi. Tesla has long discussed the potential for customers who purchase vehicles equipped with FSD to one day generate a return by offering their vehicles for use on the company's robo-taxi network when not needed for personal use. With that said, Tesla expects there will be varying degrees of interest on the part of customers when it comes to making their private vehicle available for public use; as such, it plans to augment the supply of customer vehicles on its network with a dedicated robo-taxi. Not discussed in our meeting was who would be the owner of these vehicles — if Tesla would look to sell them to commercial fleet operators or to own and operate the vehicles itself (similar to Cruise). Tesla's asset-light approach to robo-taxi service operation has in our meetings with investors often been heralded by bullish investors as a superior and more quickly scalable approach to that planned by the likes of Waymo or Cruise which we expect to own the vehicles they plan to operate.

-

Tesla expects that a dedicated robo-taxi would be less expensive for it to manufacture than one of its standard vehicles, in contrast to the robo-taxis of its competitors such as Waymo, Cruise, and others which are reported to be many times more expensive. Tesla expects to reduce the cost of a robo-taxi by utilizing its lower cost next-generation platform, and by removing unnecessary content such as the steering wheel and other driver controls, such as turn signal and wiper indicators and brake and accelerator pedals, etc. A dedicated robo-taxi is also likely to not require the same speed, handling, and performance characteristics as a retail vehicle, given its likely employment in lower speed urban environments, suggesting additional savings when it comes to the battery, powertrain, and other features. All told, Tesla could see costs falling potentially to as low as $20K per vehicle, rivaling the cost even of public transportation and representing a very significant competitive advantage vs. competitor vehicles costing reportedly ~10x as much, given their use of numerous redundant LiDAR, radar, ultrasonic, and other sensor systems.

Here's the biggest takeaway from the robotaxi conversation:

- Our Take: Competitor systems cost 10x as much as Tesla targets because of the use of redundant sensors competitors believe are critical to ensure safety and achieve regulatory approval. Tesla is pursusing a highly differentiated vision-only or primarily vision approach to autonomous driving that has the potential to be alternatively both a home run or ineffective. We do not know the outcome but fear that consensus expects and valuation demands it will be a home run, leading to Tesla capturing an out-sized share of the robo-taxi market, which is far from certain. We expect also that the timeframe for any company to generate material revenue from robo-taxi operations may be further out than market expectations. Other indications of high investor expectations along this front include TSLA shares reacting sharply positively to the announcement of the robo-taxi day and rising fully +15.3% on April 29 alone (vs. the S&P 500 +0.3%) simply on the news that China would allow some limited testing of FSD (in a way still much more restrictive than in the US). We expect Tesla to show a robo-taxi concept on August 8 and perhaps an accompanying app and to reveal more about its expected business model, but we do not expect material revenue generation likely for years to come. Some hint of this may have been implied in our meeting when it was suggested that the dedicated robo-taxi would be built on the company's next-generation platform which was elsewhere in our meeting said to not launch until the company is much closer to utilizing its current ~3 mn units of installed capacity (Bloomberg consensus currently forecasts Tesla delivering 3 mn vehicles only by 2027).

Robotaxis have the potential to be a major revenue driver for Tesla. However, as previously noted, fully solving FSD is a prerequisite before these taxis can hit the road.