Authored by Jesse Coghlan via CoinTelegraph.com,

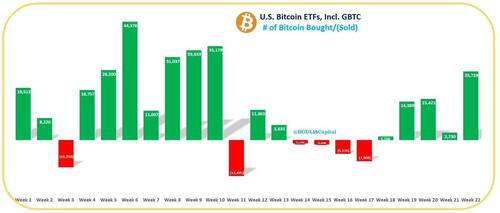

Spot Bitcoin exchange-traded funds (ETFs) in the United States acquired the equivalent of around two months’ worth of the cryptocurrency’s mining supply in the first week of June.

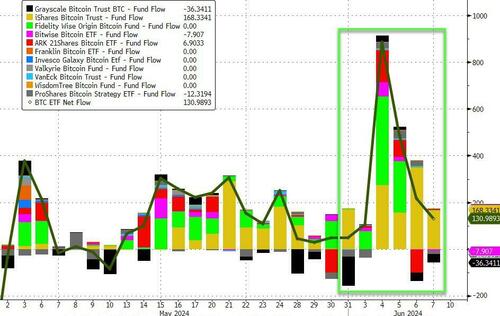

With inflows of approximately $1.83 billion, the 11 ETFs bought 25,729 Bitcoin in the trading week between June 3 and 7 - around eight times more than the 3,150 new BTC mined over the same time, according to data from HODL15Capital.

The amount of Bitcoin acquired in the week alone was almost as much as the entire of May, 29,592 BTC, per HODL15Capital’s count, and is the biggest week of buying since mid-March when Bitcoin hit its current all-time high of $73,679.

The weekly BTC buys of U.S. Bitcoin ETFs since their Jan. 11 launch. Source: HODL15Capital

The 11 ETFs have seen $15.69 billion in net inflows since their January launch, including the $17.93 billion in net outflows from Grayscale’s fund, with total assets under management (AUM) of around $61 billion.

Bitcoin proponents have long touted cryptocurrency as “digital gold” due to its built-in scarcity mechanism, which sees only 21 million BTC ever being issued.

ETF Store president Nate Geraci noted in a June 9 X post that Bitcoin ETF AUM is around 60% that of the country’s gold ETFs, despite gold ETFs being around for 20 years and Bitcoin ETFs for only five months.

Bitcoin touched a high of $71,093 on June 5 amid the surge of inflows to the U.S. Bitcoin ETFs, the first time the asset has been above $71,000 since May 21, according to Cointelegraph Markets Pro.

The cryptocurrency has struggled to pass its current high, as its price is “more heavily influenced by macroeconomic factors and geopolitical events,” crypto exchange co-founder “Radar Bear” told Cointelegraph on June 7.