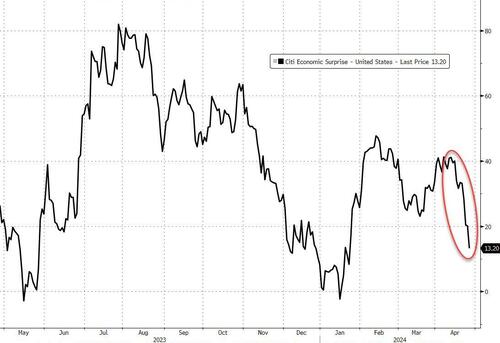

Overall, US macro data has suddenly started to disappoint (not the least of which was today's ugly GDP print)...

Source: Bloomberg

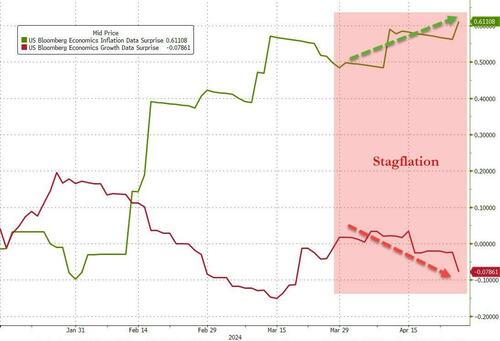

But, while 'bad news' for the economy has recently been 'good news' for stocks (enables an easier Fed), today's data 'punched that narrative in the face' with Core PCE price index in Q1 soaring considerably more than expected. And here's the problem - inflation expectations are surging at the same time as growth expectations are sliding - the nemesis of every central banker is upon us: STAGFLATION.

It's been a theme all year but recently has become so much more pronounced that not even the best 'spinners' can ignore...

Source: Bloomberg

And that sent rate-cut expectations plummeting to cycle lows (and took June completely off the table for a cut)(

Source: Bloomberg

Combine the ugly macro data with some ugly micro (META) and Goldman's trading desk noted overall flow was skewed better to sell:

LO’s driving more of the supply here with a -3% sell skew. An outlier is that we are seeing very real demand in AAPL from both HF and L/O community. META seeing very little defense from L/O . Overall activity from the group feels muted.

In the HF community we are slightly better to buy. Very notable that in macro products, short ratios are elevated to 75%. We are seeing cover buying in the Tech.

Overall, the majors were all lower close to close, but well off their knee-jerk lows from the GDP/PCE data... The Dow was the laggard on the day (with IBM & CAT the biggest points drag). The rest of the majors were all equally pummeled (though we do note that Nasdaq is still up over 2% on the week)...

The initial puked slammed The Dow and Nasdaq back below their 100DMAs and the ramp-fest back up to that critical technical level, but that couldn't hold into the close...

As you'd expect, given META's meltdown, the basket of MAG7 stocks was ugly out of the gate - and ended red - but staged a decent comeback during the day...

Source: Bloomberg

And 'most shorted' stocks followed a similar trajectory - squeezing higher after an ugly open...

Source: Bloomberg

Tech stocks overall ended marginally lower, Energy outperformed while Real Estate and Healthcare lagged...

Source: Bloomberg

Treasuries were clubbed like a baby seal on the macro data and pulled back only modestly during the day with the short-end and belly underperforming the long-end...

Source: Bloomberg

2Y Yields broke above 5.00% AGAIN... but were unable to close above it AGAIN...

Source: Bloomberg

The dollar spiked immediately higher on the GDP data, but as the day wore on, the dollar bled back its gains to end lower on the day...

Source: Bloomberg

Gold prices rallied on the day, shrugging off the vol in the dollar...

Source: Bloomberg

Bitcoin managed gain on the day after overnight weakness...

Source: Bloomberg

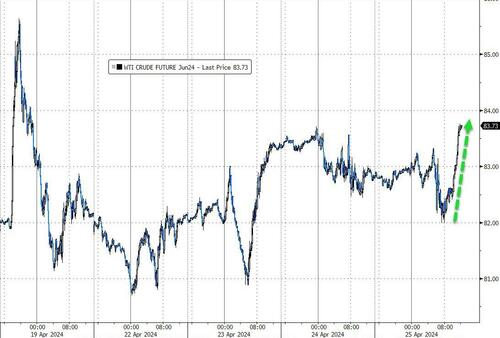

Crude prices managed solid gains after early weakness with WTI rallying back up towards $84...

Source: Bloomberg

Finally, we are down to the vinegar strokes of the week with GOOGL & MSFT tonight, and PCE tomorrow...

Source: Bloomberg

...and don't forget The Fed next week where no action is expected, but the words may speak even louder this time.