The "calm before the storm" of earnings and big macro this week (and no WW3 this weekend) was all the algos needed to ramp stocks during the US cash session after being reminded that the buyback-blackout period is almost over...

Stocks had fallen from up around 0.6% at the cash open to unchanged by the European close... and then the algos all remembered, buybacks are coming back soon to save the world and stocks went vertical... together... with everything up 1.5% at the highs before the 1430ET margin-calls and the squeeze ammo ran out, leaving stocks fading into the close (but still a solid green day after some recent pain).

...as a basket of the 'most shorted' stocks exploded higher (biggest short squeeze in a month). We not note that the squeeze stalled at an interesting level...

Source: Bloomberg

0-DTE traders were active today. Buying straddles/strangles early on, then call-buyers pounced in size, inevitably prompting early put-buyers to unwind (back to net zero delta - which seemed to end the ramp), before the straddles were unwound into the close...

TSLA was twatted again - seventh straight down-day (equal longest-losing-streak ever). The last two times it dropped seven straight days, it ripped back (Sep 2018, +50% in next two months; Dec 2022, +100% in next two months)...

Source: Bloomberg

Interestingly Goldman's trading desk noted overall activity levels are flat vs. the trailing 2wk avg, with mkt volumes down -8% vs. the 10dma

-

For the 2nd straight session we lean better to buy at +6.5% overall – this is our highest buy skew since 3/1/24

-

HFs are a massive driver of that demand tilting +22% better to buy, this ranks 98th %-ile & backs up last week’s PB report highlighting single stocks saw the largest notional long buying in over a year. HF demand tils towards Fins, Cons Disc, Indust, Info Tech & HCare with modest supply in Materials, Comm Svcs, Staples & REITs.

-

LOs are -5% better for sale which continues their theme from Friday. Supply is most concentrated in Info Tech, Fins & Industrials with modest demand for Staples, REITs & Cons Disc.

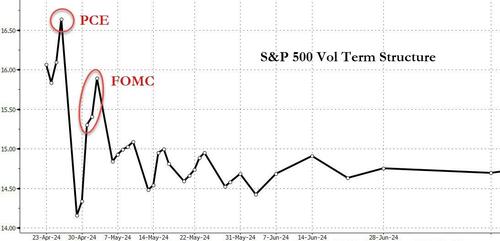

Equity vol markets are primed for the next week's action though...

Source: Bloomberg

Treasuries were relatively quiet with an overnight sell-off but bid during the day session with the short-end outperforming (2Y -2bps, 30Y unch)...

Source: Bloomberg

Once again, 5.00% was resistance for the 2Y yield...

Source: Bloomberg

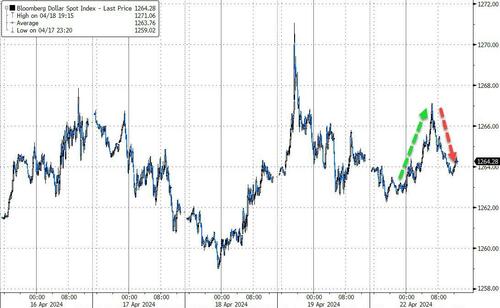

The dollar roller-coastered a little today ended unch...

Source: Bloomberg

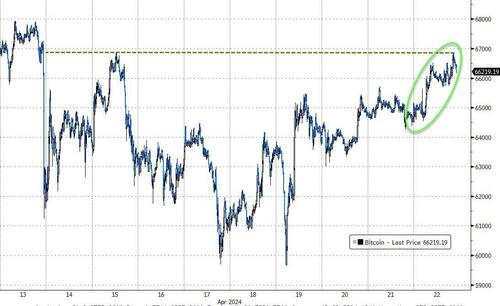

Bitcoin extended the weekend's rebound (post-halving), testing back up towards $67,000...

Source: Bloomberg

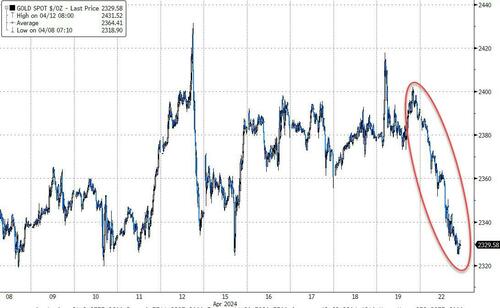

Gold, on the other hand, was clubbed like a baby seal - after rising for 13 of the last 17 days, today saw its biggest daily loss since June 2022. But that drop only pulled it back to one-week lows...

Source: Bloomberg

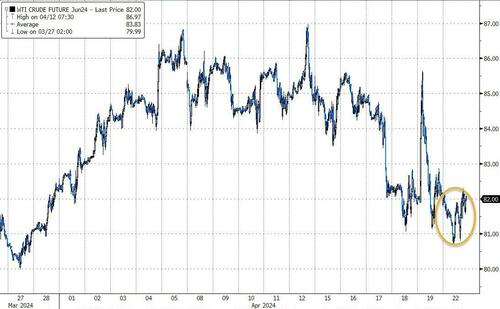

Oil prices chopped around all day with WTI hovering at $82 and ended unchanged...

Source: Bloomberg

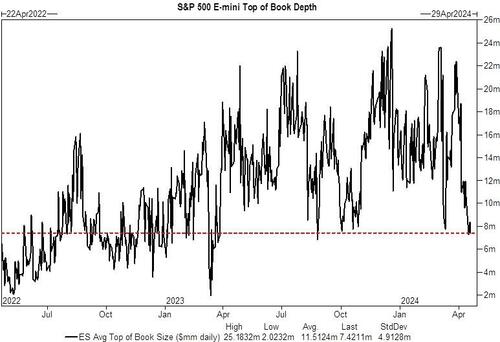

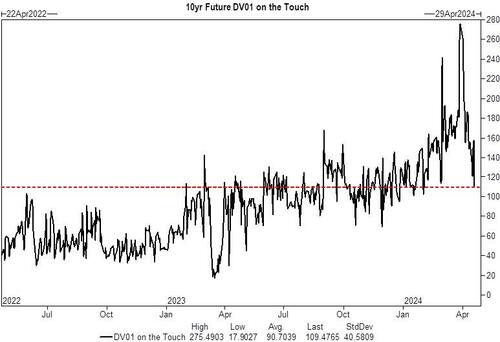

Finally, there's this... market liquidity in stocks...

...and bonds...

...is dismal - and in a week full of major macro catalysts (e.g. PCE) and massive micro events (MAG7 earnings), that will likely mean some serious gaps (and with gamma so negative, things could get violent, one way or another).