By Tsvetana Paraskova of Oilprice.com

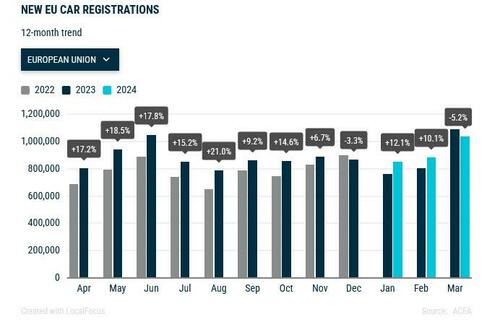

Europe’s new car sales fell in March for the first time this year, dragged down by a decline in electric vehicle (EV) registrations and the timing of the Easter holidays, the European Automobile Manufacturers’ Association, ACEA, said on Thursday.

All new car sales in the European Union car market dropped by 5.2% year-on-year to 1 million units in March, while passenger vehicle sales in Europe including non-EU members such as the UK and Norway fell by 2.8%, ACEA’s data showed.

In the EU, new electric vehicle sales slumped by 11.3% to 134,397 units in March, led by a major 29% decline in EV sales in the biggest European market, Germany.

Car sales in Norway, where most new vehicle registrations are EVs, plunged from over 19,000 cars in March 2023 to 9,750 units last month.

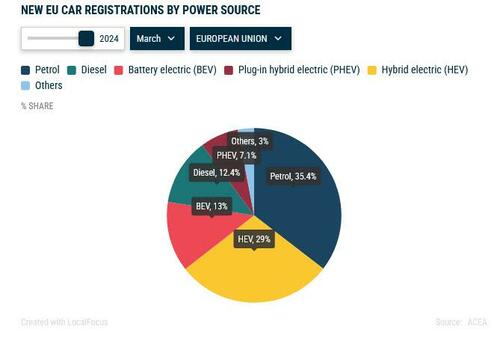

As EV sales fell in the EU, their market share shrank from 13.9% in March 2023 to 13% in the same month of 2024.

Among the three largest BEV markets, Belgium (+23.8%) and France (+10.9%) enjoyed double-digit increases, while Germany faced a significant decrease of 28.9%, ACEA said.

The EU saw a total of 332,999 new battery-electric cars registered during the first quarter of 2024, up by 3.8% compared to the same quarter last year.

Despite the general market decline, hybrid-electric car registrations in the EU jumped by 12.6% in March 2024, with France and Italy driving the increase. The share of hybrid car sales rose to 29% of the new sales last month, up from 24.4% in March 2023.

The slowdown in EV sales in recent months has not been limited to Europe.

Tesla, for example, saw its deliveries slump in the first quarter for the first annual drop since the start of the pandemic in 2020, missing analyst forecasts by a mile in a sign that even price cuts haven’t been able to stave off an increasingly heated competition on the EV market.