A number of structural themes have been driving US asset markets higher, including artificial intelligence, GLP-1, cloud, and biotech, as well as the prospect of a pivot in the Federal Reserve's interest rate hiking cycle if inflation does not reignite. Some Wall Street strategists, like BofA's Savita Subramanian, have hiked their year-end S&P price targets. However, her colleague, Michael Hartnett, has been countering the bull narrative that "it's only a small bubble, plus this time is different" in various notes (read: here, here, here, and here).

Given that some Wall Street strategists are split on the question, "1995 or 1999?" - one sell-side indicator has piqued our attention and could be an ominous sign that insiders see trouble ahead in the bull market.

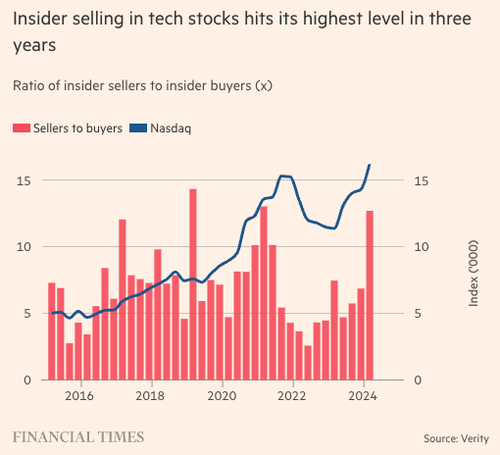

According to Verity LLC, which tracks insider trades, the ratio of corporate insider selling to insider buying has surged to the highest level since the first quarter of 2021.

Peter Thiel, Jeff Bezos, and Mark Zuckerberg are some of the top corporate insiders dumping shares this quarter. They have sold hundreds of millions of dollars in shares as the AI bubble and Fed pivot narratives propelled the Nasdaq to new record highs.

The surge in insider selling is an ominous sign the bull market could be nearing a resistance level, Charles Elson, a legal veteran and chair of corporate governance at the University of Delaware, told the Financial Times.

"If they think that we're at the top and so they're getting out, that's a rather stark signal to everyone else," Elson said.

Ben Silverman, Verity's vice president of research, warned:

"We do view [corporate insider share sales] as a negative data point that investors should be aware of."

Silverman noted that the selling appears to be concentrated in the technology sector specifically, "We are also seeing a number of the big [company] names in this space with insider selling that is not typical."

"Clearly there's an appetite for liquidity generation right now," he said, adding, "Some of that is some pent-up demand following relatively quiet insider selling in 2022 and 2023, and certainly one impetus is [stock] market performance."

FT listed the most recent selling transactions of Thiel, Bezos, and Zuckerberg:

- Many of the biggest sales this quarter have come from technology executives. Thiel, co-founder of data analytics group Palantir, sold $175mn this month, according to regulatory disclosures, his biggest sale since offloading $504.8mn of the company's stock in February 2021.

- Amazon founder Bezos sold 50mn shares worth $8.5bn in the ecommerce group in February. Andy Jassy, Amazon's chief executive, sold $21.1mn of stock this year, compared to $23.6mn in 2023 and 2022 combined.

- Zuckerberg, Meta's chief executive, has sold millions of dollars of the company's shares for years. But he has increased selling this year as its stock hit all-time highs. In early February, he sold 291,000 shares for $135mn, his first sale of that size since November 2021. He still has 13.5 per cent of the company's outstanding shares, which makes him its largest shareholder.

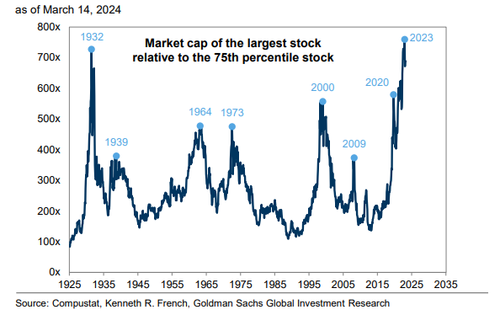

Some corporate insiders may recognize what BofA's Hartnett has seen in equity markets: bubbly times. Even Jamie Dimon, the world's most powerful banker, warned earlier this month: "There's a little bit of a bubble in equity markets right now."

Nothing to see here (courtesy of Goldman):

Higher markets from here would only suggest more insiders will be dumping.