Crypto exchange BitMEX is currently investigating “unusual activity” involving large sell orders on its BTC-USDT spot market overnight that sparked a flash-crash dragging the price of BTC (in USDT) down below $9,000 (while the price remained above $66,000 on other exchanges)...

Doesn't seem like a very smart move for the 'rogue seller' to dump over 400 BTC at that time of day into an illiquid market - why not wait until the US BTC ETF market is running its magic and sell into that liqudity?

The USD price of BTC has been falling ever since...

A spokesperson for BitMEX said the company investigated the incident and found evidence of “aggressive selling behavior involving a very small number of accounts that exceeded expected market ranges,” adding that its systems had operated normally and all user funds are safe.

“We launched an investigation as soon as we noticed unusual activity on our BTC-USDT Spot Market. Despite all our systems operating normally, we identified aggressive selling behavior involving a very small number of accounts that exceeded expected market ranges. Our compliance is thoroughly investigating relevant individual accounts, and will keep our users appraised of any necessary measures in the future," BitMEX spokesperson further told Cointelegraph.

“Someone just dumped 400+ BTC over 2 hours in 10-50 BTC clips on the XBTUSDT pair on Bitmex eating 30%+ slippage. They must've lost $4m+ at least,” pseudonymous crypto community member “syq” wrote.

“I'm guessing that they're done (for now?). Total volume so far is just shy of 1,000 BTC over 3.5 hours with a low of $8,900. Now BitMEX have disabled withdrawals,” they added.

The exchange later posted on X:

“This does not affect any of our derivative markets, nor the index price for our popular XBT derivatives contracts.".

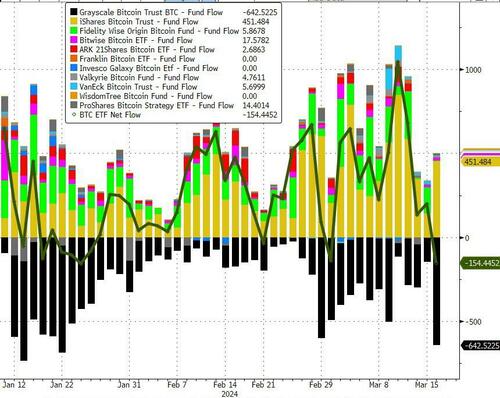

Notably yesterday saw the biggest net outflows from the BTC ETF complex sincxe inception, dominated by GBTC liquidations...

Which is interesting given the timing of the flash crash and the fact that the former CEO of BitMEX, Arthur Hayes, previously opined that the spot Bitcoin exchange-traded funds (ETFs) could “completely destroy” Bitcoin if they are too successful.

According to Hayes, Bitcoin ETF issuers holding all the BTC would negatively impact the number of transactions on the Bitcoin network, and miners will lose any incentive to keep validating transactions.

“The end result is miners turn off their machines as they can no longer pay for the energy required to run them,” said Hayes.

“Without the miners, the network dies, and Bitcoin vanishes.”

Meanwhile, MicroStrategy, one of the largest public holders of Bitcoin, has completed another convertible notes offering to increase its Bitcoin stash.

The notes sold in the offering amounted to $603.75 million, including $78.75 million aggregate principal amount of notes issued pursuant to an option to purchase.

“I’m going to be buying the top forever. Bitcoin is the exit strategy,” Saylor said after being asked if his firm would sell its stash counting 190,000 BTC at the time.