Over 10,300 X users participated in a survey we conducted almost a month ago, asking: "Have you used Grok, ChatGPT, Gemini or any other AI chatbot in the past week?"

The final result: 61.8% responded "No," while 38.2% said "Yes."

With Nvidia shares up 80% year-to-date and fueling an epic artificial intelligence boom, the one question that lingers in the minds of well-seasoned traders: When does the music stop?

The music might not be stopping yet, but the tempo is undoubtedly beginning to slow. Consider this note from the tech blog The Information:

In the past year, major technology firms have championed generative artificial intelligence as the next big thing, boosting the stock market to new highs. But behind the scenes, representatives of major cloud providers and other firms that sell the technology are tempering expectations with their salespeople, saying the hype about the technology has gotten ahead of what it can actually do for customers at a reasonable price.

Several executives, product managers and salespeople at the major cloud providers, such as Microsoft, Amazon Web Services and Google, also privately said most of their customers are being cautious or "deliberate" about increasing spending on new AI services, given the high price of running the software, its shortcomings in terms of accuracy and the difficulty of determining how much value they'll get out of it.

If The Information's reporting is correct, then it's more supportive evidence the AI hype bubble is fading.

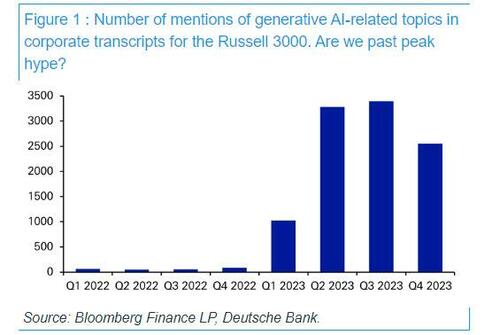

Last month, Deutsche Bank's head of thematic research, Jim Reid, pointed out in a note to clients that artificial topics mentioned on Russell 3000 earnings transcripts peaked in the third quarter.

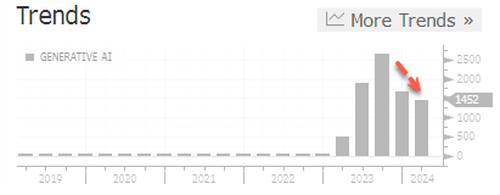

The latest earnings call data from Bloomberg shows that the number of times "generative AI" has been mentioned continues to decline quarterly.

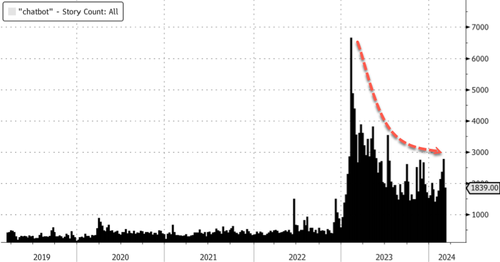

Even the number of headlines in corporate media mentioning "chatbot" peaked over a year ago.

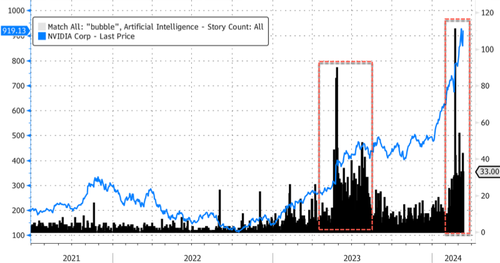

However, the number of mentions "AI bubble" in corporate press surges as Nvidia makes new highs.

And recently, we published a note from Benjamin Picton, Senior Macro Strategist at Rabobank, titled "Stock Prices Have Reached What Looks Like A Permanently AI Plateau," which also cited the Cisco Dot Com analog overlaid with current Nvidia price action.

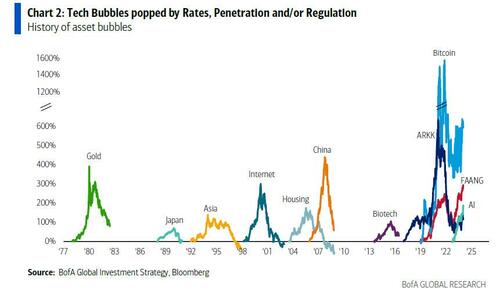

And what could pop the AI bubble?

BofA's Michael Hartnett recently told clients about rates, penetration, and regulation.