Just when you thought the EV market couldn't get more saturated or competitive in China, sales have once again slowed and the country's market leader, BYD, is once again implementing price cuts.

Sales of BEVs were up 18.2% in January-February compared to 20.8% for 2023, according to China Passenger Car Association reported by Reuters.

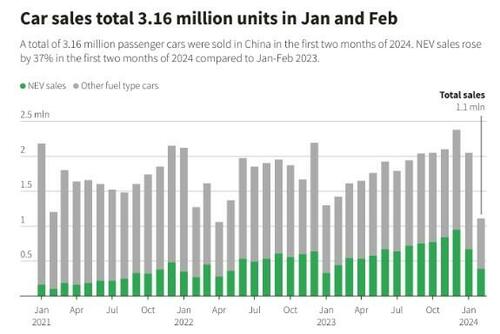

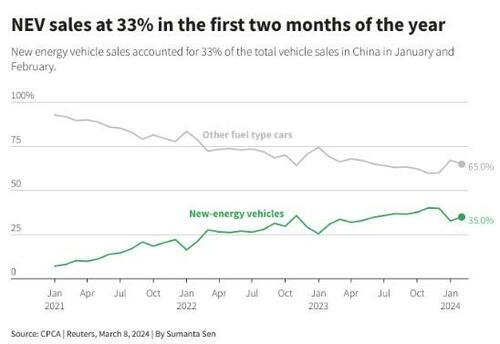

When added to hybrids and new energy vehicles, sales were up 37.5% in the period, compared to 36.2% for all of 2023, proving that the EV market continues to gravitate toward the practicality and affordability of hybrids versus all battery electric vehicles.

Reuters noted that overall passenger vehicles were up 16.3% for the year.

The report said that in the initial months of the year, EVs comprised 33.5% of total car sales, up from 28.3% in the same period last year, outpacing sales of gasoline cars which increased by 7.8%.

According to Cui Dongshu of the China Passenger Car Association, some EVs are competitively priced with gasoline vehicles, impacting their sales.

Leading the price reductions, BYD decreased prices across many models by an average of 17%, affecting 93% of its sales in China for 2023. This included a nearly 12% cut for its top-selling Yuan Plus and a 5% cut for the Seagull, its most affordable EV.

Several automakers have joined this price competition, offering discounts between 9% to 17%. Despite these cuts, BYD's market share dropped to 30.7% in February, the lowest since June 2022, even though it remains the largest EV seller globally, surpassing Tesla with most sales in China.

BYD exported 19% of its vehicles in February, marking its highest export ratio, contributing to China's 18% increase in car exports, with EVs making up 26.4% of this total.

Exports are vital for manufacturers facing weak domestic demand, with significant sales in markets like Australia, where Chinese EVs benefit from subsidies and lack trade barriers. However, this export success has led to tensions, with Europe and the U.S. investigating Chinese EV subsidies and potential security risks.