Oil prices pushed higher Thursday on worries that nuclear talks between US and Iran might not avert a new conflict that could threaten supplies.

"Oil is extending its gains, with Brent crude back above $70 a barrel... as fears of a military confrontation between the US and Iran rattled energy markets," said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

"Nuclear talks between the two sides appear to be going nowhere fast, and the geopolitical premium is clearly back in play," he added.

On top of that, API reported an across the board draw in energy inventories.

“The failure to resolve core areas of contention continues to tip the scales in favor of another military confrontation,” RBC Capital Markets analysts including Helima Croft said in a note.

“The massive buildup of US military assets in the region as well as the recent Iranian naval exercise in the Strait of Hormuz seem to suggest that the launch sequence for a second military conflict has commenced.”

Will the official data confirm API's draws and build (pun intended) on the geopolitical risk premia in crude prices...

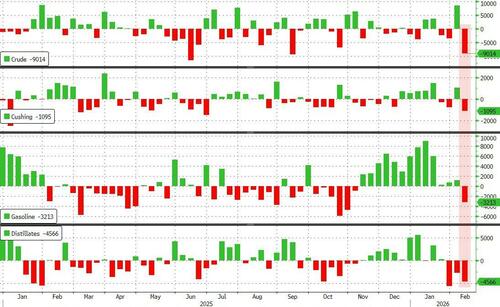

API

Crude -609k

Cushing -1.4mm

Gasoline -312k

Distillates -1.6mm

DOE

Crude -9.014mm - biggest draw since Sept 2025

Cushing -1.095mm - biggest draw since Jun 2025

Gasoline -3.21mm - biggest draw since Oct 2025

Distillates -4.566mm

The official data confirmed API with inventory draws across the board. Crude saw its biggest destocking since September and Gasoline stocks fell for the first time since Nov7th...

Source: Bloomberg

US crude production extended its rebound from the storm slowdown...

Source: Bloomberg

WTI is trading near $67 after the official inventory data, extending gains...

Source: Bloomberg

"Geopolitical issues, above all Iran, are the key bullish factor in the oil market at the moment," University of Texas-Austin energy analyst Ben Cahill tells Axios via email.

"Otherwise there's not a whole lot of price support toward $70 [per barrel]. The slack in this market could embolden the White House," he said.

Iran exports about 1.5 million barrels per day, mostly to China. But the Strait of Hormuz, the narrow sea passage next to Iran, is a choke point that handles a whopping one-fourth or so of the world's maritime oil trade.

"For oil markets, the concern is clearly what action would mean not only for Iranian oil supply, but also broader Persian Gulf oil flows, given the risk of disruption to shipments through the Strait of Hormuz," ING analysts said in a note on Wednesday.

Daan Struyven, Goldman Sachs co-head of global commodities research, told CNBC that he thinks the market sees tensions escalating further between the US and Iran, a likely catalyst for price hikes and longer-term volatility.

"Both prediction markets and oil markets are pricing some near-term moderate escalation as the base case," he said.

Specifically, if tensions in the Strait were to curtail flows by 1 million barrels per day for an entire year, Struyven predicted that would justify an $8 per barrel price increase, a roughly 11% jump from Thursday's price for Brent crude around $71.50. However, he also noted that fear among traders could push prices even higher, adding to the volatility in the market.

Loading recommendations...