The week's lone coupon auction, was also one of the ugliest 20Y auctions since its inception in May 2020.

Moments ago, the Treasury sold $16 billion in 20Y paper in an especially disappointing auction: here are the details.

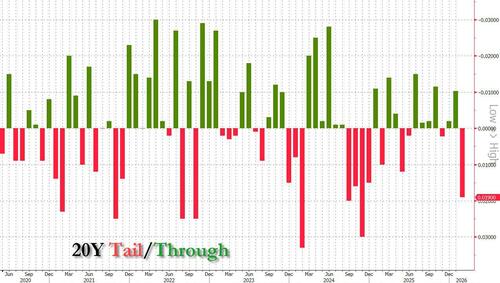

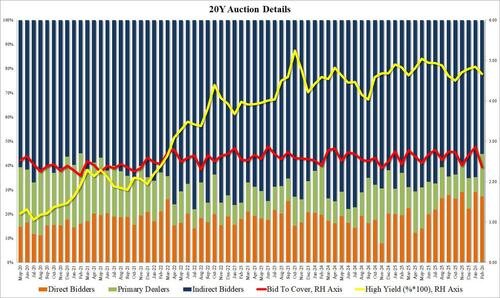

The auction stopped at a high yield of 4.664%, down from 4.846% in January and the lowest since October. It tailed the When Issued 4.644% by a whopping 2bps, the biggest tail since November 2024.

Going down the list, the Cid to Cover tumbled to 2.36 from 2.86 (one of the highest on record), the lowest btc since (also) November 2024.

The internals were also dismal, as foreign buyers fled. Indirects took down just 55.167%, down from 64.715% in January and the second lowest on record (only Feb 2021 was worse).

And with Directs awarded 27.2%, down from 29.1% in January but above the recent average of 26.9%, Dealers were left with 17.6%, the highest since December 2024.

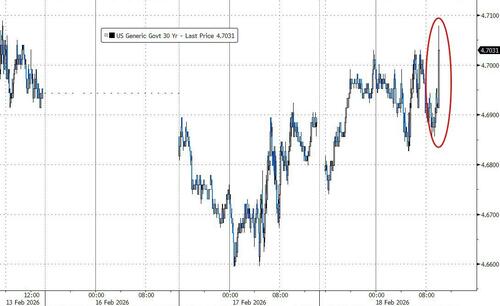

Overall, this was an extremely ugly auction, and one which dragged both 10Y and 30Y yields to session highs after the break.

Loading recommendations...