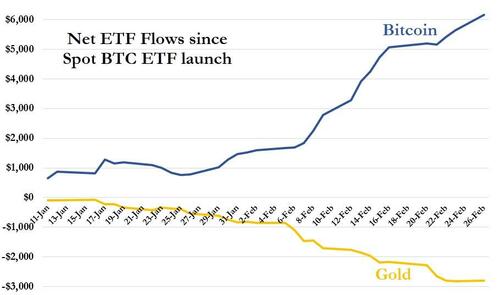

Since the launch of spot bitcoin ETFs - much to the chagrin of Gensler, Warren et al. - over $6BN of net inflows have been invested into the various vehicles (while Gold ETFs have seen almost $3BN of net outflows)...

The last few days have also seen outflows from the legacy GBTC slow to a trickle with yesterday's net inflow over $500 million...

Source: Bloomberg

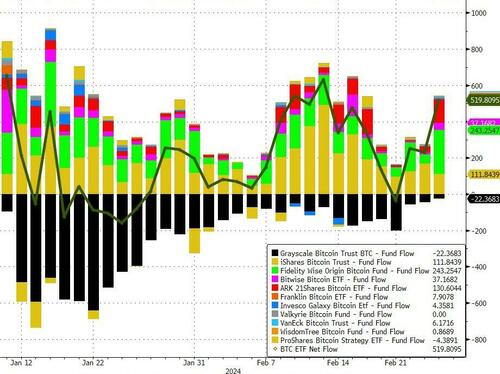

Volumes have been relatively stable but we do note that volumes are switching from fund to fund. Last week we saw a surge in volumes in HODL and as Bloomberg's ETF guru, Eric Balchunas (@EricBalchunas) points out, this week has seen a rising interesting in IBIT:

"Another thing about $IBIT volume that's notable is the amt of pre-market activity..

check this out, it's already seen $80m traded... only 5 ETFs have seen more activity ahead of mkt open. Unprecedented for 2mo-old ETF.

$BITO in 9th place makes me think lot of arb volume going on."

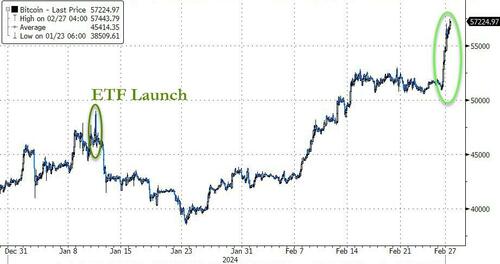

This has all helped push bitcoin back above $57,000 for the first time since Nov 2021...

Source: Bloomberg

In fact, as CoinTelegraph reports, Bitcoin short sellers are nursing millions in losses after Bitcoin rocketed upward by nearly 11% to briefly notch a new yearly high of $57,000.

According to data from crypto data platform CoinGlass, over $161 million in BTC shorts were liquidated in the last 24 hours. Traders looking to gain short exposure to Ethereum didn’t fare much better, with liquidations reaching almost $44 million within the same timeframe. More than $268 million in short positions were liquidated as Bitcoin briefly touched $57,000.

More than $270 million in short positions were liquidated in total as the market spiked upward.

In a statement to Cointelegraph, Swyftx lead analyst Pav Hundal described the crypto market as being “on fire right now.”

“We’re at average per-person trade volumes in retail that we last witnessed at the top of the last bull run in November 2021, plus institutional buying pressure is immense,” he said.

“Exchange Traded Funds alone are cannibalizing close to a quarter of the Bitcoin that is currently being produced by the network,” Hundal added.

Tyler Winklevoss, co-founder of United States-based crypto exchange Gemini, offered succinctly, “We’re so back!” while outspoken BTC bull Dan Held said today’s price action marked “the beginning of the Bitcoin bull run.”

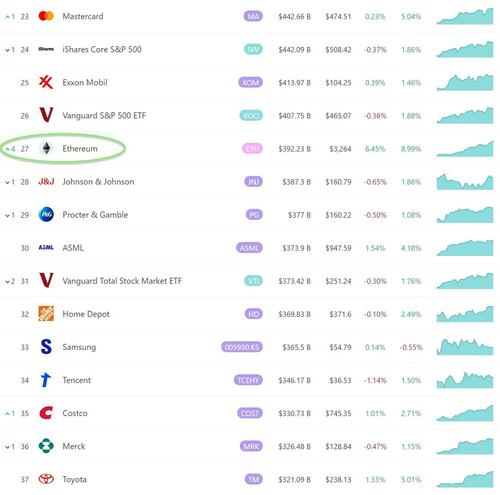

And ethereum up near $3300 for the first time since April 2022...

Source: Bloomberg

Options traders appeared to be anticipating some upward movement in ETH...

This surge in price has pushed bitcoin above $1.1 trillion in market cap (bigger than Berkshire Hathaway and almopst as large as Meta) and ethereum

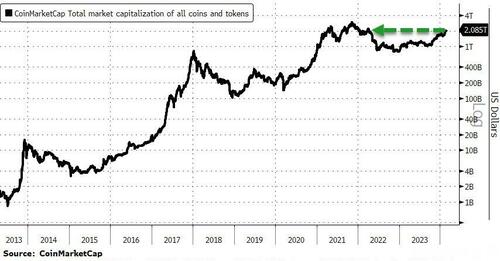

And overall, the combined value of the cryptocurrency market has jumped to around $2 trillion for the first time in almost two years on the back of the ETF-fueled rally in Bitcoin.

Source: Bloomberg

“Bullish momentum in crypto is unfolding despite an uptick in rates,” Fundstrat Global Advisors Head of Digital-Asset Strategy Sean Farrell wrote in a note.

“We do not expect a major pullback from Bitcoin given its breakout and positive intermediate-term momentum,” Katie Stockton, founder of Fairlead Strategies, wrote in a note.

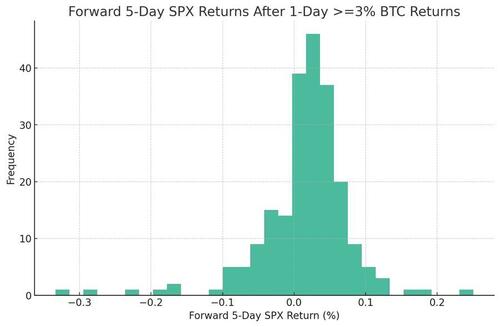

Finally, SpotGamma made an interesting observation. Big BTC days appears to be correlated to positive equity returns. Here are the forward 5 day SPX returns after times where prior 1 day BTC returns are +3%...

As Bloomberg reports, the massive inflows into Bitcoin ETFs have prompted some industry watchers to warn of a looming supply squeeze as miners fail to generate enough coins to keep up with demand. Some 80% if Bitcoin’s supply hasn’t changed hands in the past six months, potentially exacerbating the squeeze and adding to the upward price pressure, according to Julius Baer digital-assets analyst Manuel Villegas.

After the token’s so-called halving in April — where the block reward for miners will shrink to 3.125 Bitcoin from 6.25 Bitcoin — overall supply will fall further and the shortage “would reach aggravated levels,” Villegas said in a note on Tuesday.

“All in all, we see a very sound fundamental backdrop for Bitcoin and believe that prices are well supported around current levels with further upside potential,” Villegas wrote.

Bitcoin has outperformed all traditional asset classes this year.