By Ven Ram, Bloomberg markets live reporter and strategist

Brick-and-mortar stocks are getting swept up in the hysteria surrounding technology names, but the S&P 500 can’t forever outperform the US economy — with even Warren Buffett unable to find stocks to buy at sensible prices.

The equity benchmark has already totted up 7% in gains in just the first two months of the year, taking its advance since the Federal Reserve started raising rates in this cycle to about 20% — a period when you would think rising interest rates would have acted like gravity to pull down stocks from their highs. With the Nasdaq 100 moving along like a veritable juggernaut, there are no prizes for guessing that sentiment is often a more powerful driver than fundamentals.

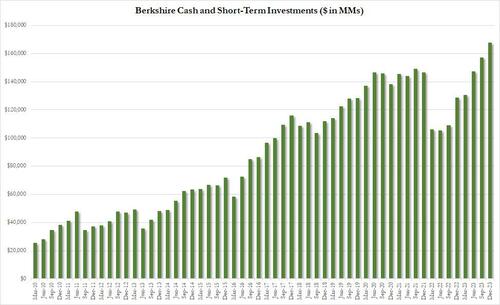

Even so, it’s worth noting what Buffett’s Berkshire Hathaway has been doing in the past few years: building up its arsenal of cash and short-term investments when it can’t find meaningful businesses to invest in at reasonable prices. Its cash pile surged some 30% at the end of last year to almost $168 billion — the clearest indication that the legendary investor is waiting for an inflection point in the markets.

In his annual letter to shareholders delivered over the weekend, Buffett wrote:

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced.”

Here’s one of the smartest investors hinting that he is unable to deploy Berkshire’s massive cash hoard in meaningful size, even though the rest of the world seems to be charging ahead with nary a concern about how this might all end.

At current levels, the Nasdaq 100 is trading at a P/E of some 33x, and the S&P 500 is just following in tow. But when some of the best minds in finance can’t deploy their cash meaningfully, it may be time to turn a bit cautious.