It is refunding week, which means we get the usual staple of 3, 10 and 30Y auctions. And moments ago, the Treasury just concluded the first of three coupon sales when it sold $58BN in 3 Year paper in a very strong auction.

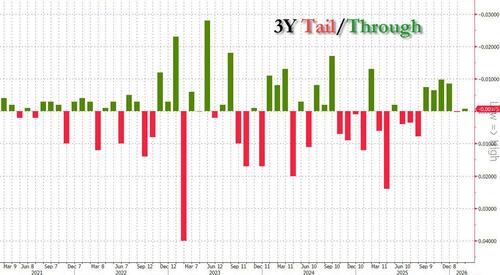

The auction stopped at a high yield of 3.518%, down from 3.609% in January and the lowest yield since Sept 2025; the auction also stopped through the 3.519% When Issued b 0.1bps, the 6th consecutive stop through for the 3Y tenor.

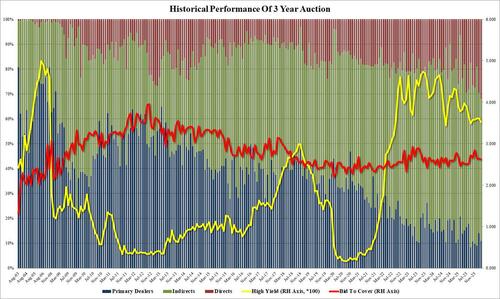

The bid to cover was a bit disappointing at 2.624, down from 2.650 in January and below the recent average of 2.676.

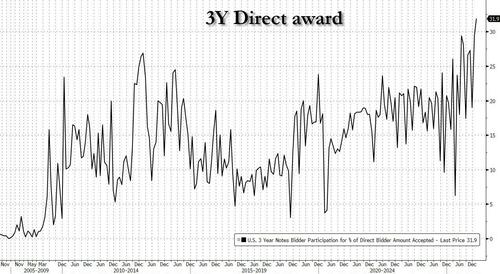

Internals were also notable, with Indirects awarded 57.15%, up from 56.50% but well below the recent average of 63.73%. And with Dealers holding 10.94%, that left Directs with a whopping 31.92%, up from 29.50% and the highest on record. This curious dynamic - declining Indirects offset by rising Directs - has been a staple for coupon auctions for the past several years now and we see it accelerating in the future, especially if foreign reserve managers rotate away from the US.

Overall, this was a solid auction, yet one where the drop in foreign demand was notable, even if offset by record direct buyers

The lack of major surprise explains why 10Y yields barely budged after the auction prices just after 1pm ET.

Loading recommendations...