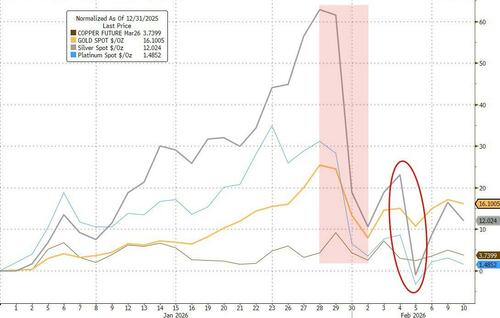

The near-vertical surge in precious metals (arguably driven by speculative demand from China) came to a swift halt at the end of January, when silver suffered its biggest daily drop on record and gold plunged the most since 2013.

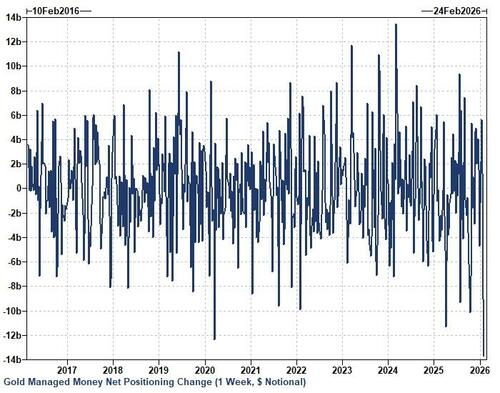

As Goldman's top futures trader, Robert Quinn, points out (in a note available at out MarketDesk.ai portal to professional subscribers), according to Commitment of Traders reports, Managed Money sold a record amount of Gold futures surrounding month-end.

The report covering January 27th - February 3rd, which included a -11.4% drop post Trump's nomination of Kevin Warsh for Fed Chair, displayed-$13.7bn of Managed Money selling, driven mostly by liquidation (-$12.1bn).

This marked a 10 year notional record and corroborated the plummet in aggregate open interest.

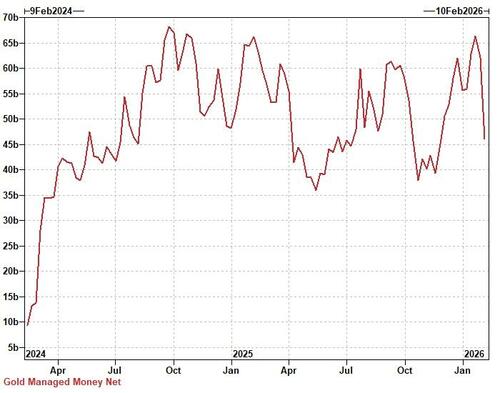

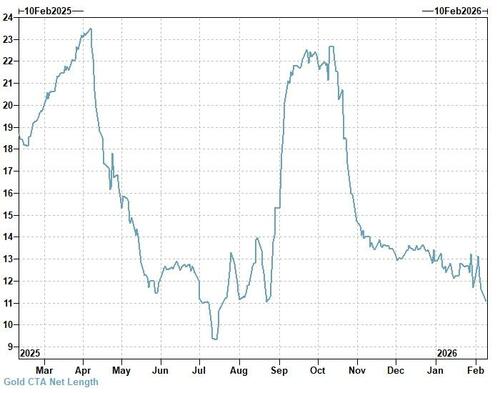

Over subsequent sessions, elevated price volatility caused additional long unwinds, consistent with flow models for systematic investors.

From February 3rd - 5th, Gold price and open interest lost -0.9% and -$4.3bn respectively. GS Futures Strategists' CTA model estimated some Gold selling. Similarly, the risk parity framework projected widespread commodity liquidation.

However bulls eventually returned alongside renewed Dollar weakness.

After initially proving resilient through Mega-Cap Tech weakness, the broad Dollar index lost -1.0% during February 5th -9th, enabling a +3.9% Gold bounce.

Catalysts included the US administration's signaling of an imminent soft labor report plus Chinese regulators' advice to curb holdings of US Treasuries.

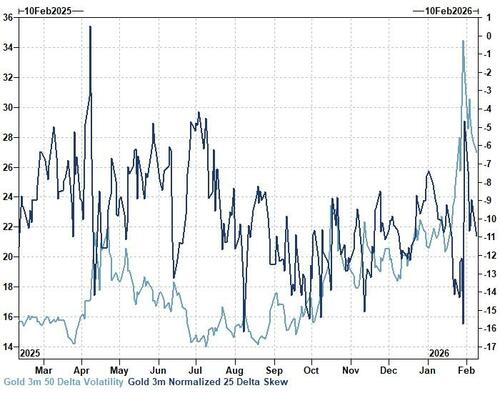

Gold aggregate open interest regained +$2.7bn. Moreover, normalized 25 delta put-call skew cheapened across the curve.

Meanwhile, UBS points out that Silver ETFs have now been sold so heavily in 2026 that it has erased all net buying in 2025...

Many of the factors that underpinned the multiyear rally — heightened geopolitical risks, elevated central-bank buying and lower interest rates — remain in play.

“The recent bout of volatility has called into question the value of gold as a hedge against geopolitical and market swings,” Mark Haefele, global wealth management chief investment officer at UBS Group AG, wrote in a note.

“We believe such worries are overdone, and that the rally in gold will resume.”

Many other banks and asset managers, including Deutsche Bank and Goldman Sachs, have backed a recovery in bullion.

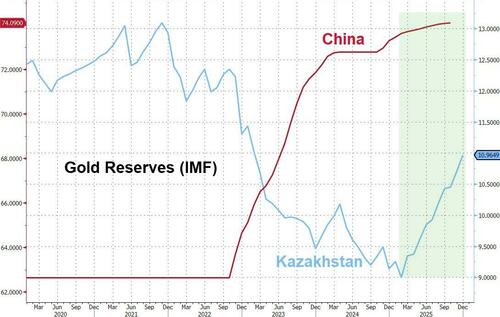

Underscoring resilient official demand, the Chinese central bank extended its gold buying to a 15th month in January, and Kazakhstan's central bank bought 66 tons of gold last year, becoming the world's second-largest buyer of the metal, Governor Timur Suleimenov told President Kassym-Jomart Tokayev, boosting overall gold reserves to 345 tons.

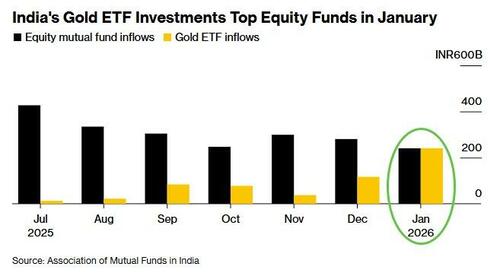

Away from the big banks, retail is well and truly involved as Bloomberg reports that Indian investors poured more money into gold exchange-traded funds than equity mutual funds in January, a rare crossover that highlights sustained demand for bullion despite a record-setting surge fueled by geopolitical and monetary risks.

Net inflows into gold ETFs surged to a record 240.4 billion rupees ($2.65 billion), slightly higher than stock fund inflows of 240.3 billion rupees, according to data released Tuesday by the Association of Mutual Funds in India.

The milestone marks one of the strongest monthly endorsements of bullion by local investors in recent years.

“Investors are shifting allocations toward gold against the backdrop of a relatively lacklustre year for equity and stellar returns posted by gold in the same period,” said Nirav Karkera, head of research at Fisdom, a wealth management platform.

Investment demand for gold will likely stay firm, at least until clarity emerges on the macroeconomic front, he added.

As Bloomberg highlights, the move reflects a wider global pattern.

Gold ETF holdings worldwide remain near a more than three-year high, even after a pullback in prices last week, as the drivers behind the blistering rally - including elevated geopolitical risk and waning confidence in sovereign bonds and currencies - remain in place.

It's not just central banks and retail that are getting (staying) bulled up again. As Goldman concludes, even longer-term investors potentially re-engaged.

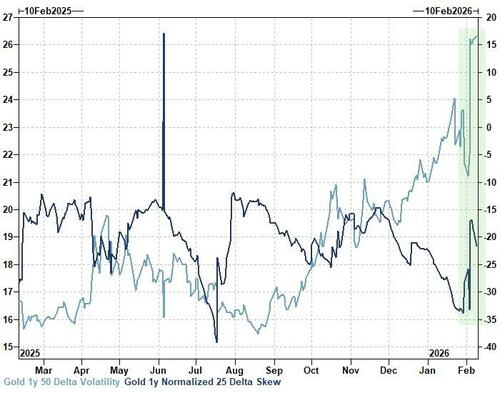

As realized volatility subsided, 1 month and 3 month implied volatility also declined.

However 1 year implied volatility continued to richen and remained near local highs.

Thus, Goldman's Quinn concludes, long-dated call buying likely manifested.

Loading recommendations...