The SpaceX IPO, potentially launching as early as mid-June, is set to accelerate the "space investment" theme we previously outlined, with Elon Musk's rocket company rumored to target about $50 billion in proceeds at a $1.5 trillion valuation.

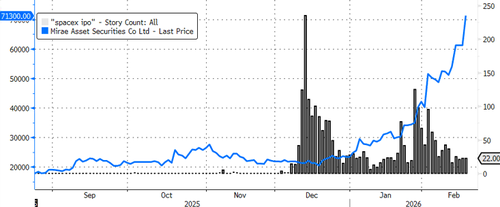

Early bullish sentiment is already appearing in one public-market proxy: Seoul-based Mirae Asset Securities Co., which has about $400 million of exposure to SpaceX and xAI, and has surged to the top spot on MSCI's broadest global stock index performance so far this year.

Ha SeokKeun, CEO at Eugene Asset Management Co., was quoted by Bloomberg as saying that Mirae Asset's fundamentals are improving due to the strong Korean stock market, while its SpaceX position provides an additional catalyst, allowing investors to capture two sources of value simultaneously.

Mirae Asset's brokerage revenue jumped to a record in 2025, up 43% over the previous year, according to its earnings report last week. The stock is trading at 21 times forward earnings estimates, or triple its five-year average.

KB Securities Co. analyst Kang Seunggun warned that the stock's valuation is elevated and that the benefits of its high portfolio valuations remain unclear.

There was roughly a one-month lag between the corporate media headlines about the SpaceX IPO in December and the market pricing in Mirae Asset's SpaceX exposure.

"Most of the earnings increase comes from unrealized gains in consolidated funds, limiting the direct impact on standalone capital," Kang wrote in a note earlier this month. "As a result, we see greater uncertainty in translating valuation gains into shareholder returns."

We have told readers the space theme is well underway, as well as ways to profit:

A year ago, we mapped out Starlink's satellite supply chain as the space theme started to emerge:

Could the AI bubble morph into the space bubble?

Loading recommendations...