Fake food company Beyond Meat, once endlessly promoted by globalist corporate media trying to convince the nation that cow farts are bad and fake meat is good, has been locked in a near five-year bear market. It seems that Redditors and the company's press release are squeezing shares higher. However, a recent debt swap for equity will substantially dilute shareholders. We've seen this story before, and it never ends well.

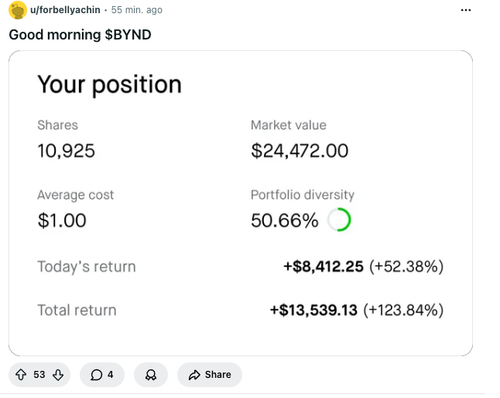

News this morning that Beyond Meat plans to expand its fake food products to over 2,000 Walmart stores nationwide sent shares up 60% in premarket trading. The surge is likely due to a combination of the Reddit army of day traders catching on that hedge funds have been heavily shorting the stock.

Beyond Meat's latest short interest data show that 54% of the company's publicly available shares are short, or about 39.59 million shares. Based on the average daily volume of around 9 million shares traded per day, it would take 4.44 days for shorts to cover.

Meanwhile, day traders on Reddit's WallStreetBets page are all about BYND...

Hmm.

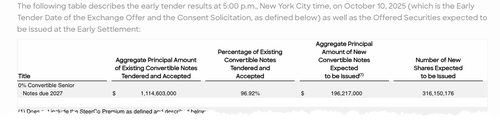

The surge comes one week after nearly all creditors agreed to a debt-swap deal that massively dilutes equity shareholders.

BYND wrote in a recent press release (read report) that 96.92% of holders of its 0% Convertible Senior Notes due 2027 agreed to participate in the debt-equity swap offer, clearing the 85% threshold required for the deal to proceed.

Under the terms, BYND will issue up to $202.5 million of new 7% Convertible Senior Secured Second Lien PIK Toggle Notes due 2030 and up to 326.2 million new shares of common stock. The exchange aims to reduce leverage and extend debt maturities.

And now you understand why there's a squeeze and pump.

Liquidity is needed. Reddit kids are that liquidity. Never ends well.

Loading recommendations...