Precious metals have been clubbed like a baby seal this morning with Gold down over 5% (biggest drop since Aug 2020)...

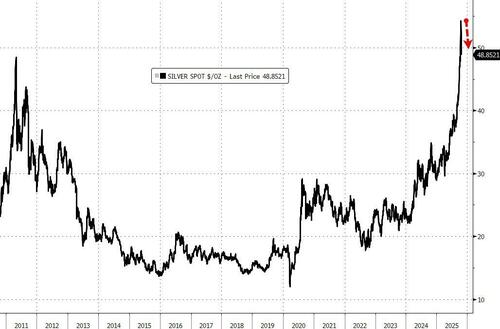

Silver is doing even worse, down over 7% (biggest drop since Feb 2021)...

No, there's no obvious headline catalyst for this move with trading desks citing extreme overbought markets ripe for a pullback along with extreme length (and huge ETF flows in recent weeks) being unwound.

“In the last couple of trading sessions traders have increasingly been looking over their shoulders, as concerns about a correction and consolidation have arisen,” said Ole Hansen, commodities strategist at Saxo Bank AS.

“It’s during corrections that a market’s true strength is revealed, and this time should be no different, with an underlying bid likely keeping any pullback limited.”

Arguably, safe-haven demand for precious metals has cooled somewhat as US President Donald Trump and China’s Xi Jinping are set to meet next week to iron out their differences on trade, and a seasonal buying spree in India has ended.

Specific to the silver side of the slump, benchmark prices continued to trading above New York futures, which has prompted traders to ship metal to the UK capital to ease tightness.

On Tuesday, silver in vaults linked to the Shanghai Futures Exchange saw the biggest one-day outflow of silver since February, while New York stockpiles have also fallen.

And the EFP spread has collapsed (as the transport has apparently eased the tightness in physical silver markets)...

Some suggested it was dollar strength today (but we have seen gold and the dollar total decouple in recent weeks so we highly doubt that, unless straw/camel's back etc)...

However, a little context is always useful...

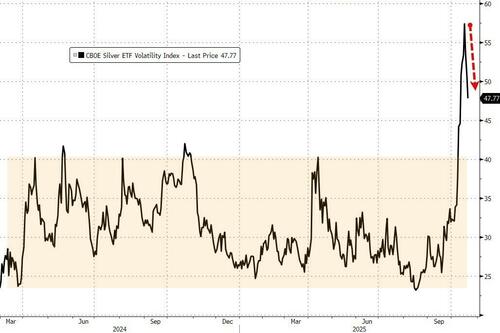

The vol breakouts have busted (as chasers levered calls into the endless gains)

Silver vol is almost back within its 'normal' range...

But gold has a long way to go...

Meanwhile, we note that silver's dramatic underperformance came at critical support levels against gold (at the 80x ratio that has been significant for years)...

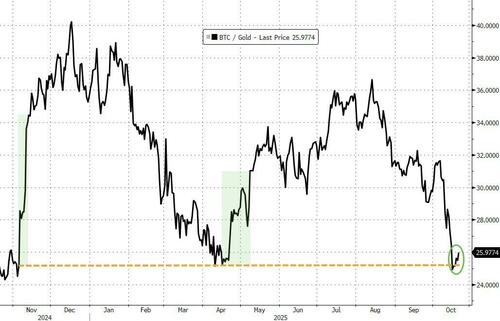

Additionally, relative to crypto, gold had got back to a key resistance level (that acted as serious support for the BTC/Gold ratio twice before - the election and liberation day)...

On the 'bright' side, this decline has dragged gold and silver back from perilously overbought levels...

Bloomberg notes that with the ongoing US government shutdown, commodity traders have also been left without one of their most valuable tools - a weekly report from the Commodity Futures Trading Commission that indicates how hedge funds and other money managers are positioned in US gold and silver futures. Without the data, speculators may be more likely to build abnormally large positions one way or another.

“The absence of positioning data comes at a delicate time, with a potential build-up in speculative long exposure in both metals making both more vulnerable to correction,” Hansen said.

UBS traders say that the next level to watch is the Oct. 15 low at 4165, before 4095/4100 which held on dips on Oct. 14; then it is the 4060 level which briefly capped the advance on Oct. 8/9.

Loading recommendations...